4 Reasons to Pull out an effective 401(K) Financing

Given that rising prices increases, you might be seeking it hard to get to know their monthly costs. A recently available questionnaire found that 54% out-of Us citizens are dipping in their discounts and then make comes to an end meet. Some are considering their 401(k) balance and you will curious if they can tap into its retirement savings to handle ascending can cost you.

Although you normally withdraw funds from your own 401(k) directly in whatever increments you choose, taking that route may cause charges having early withdrawal. you reduce the brand new taxation experts to your any money taken. Therefore lead withdrawal will get enhance your own already-ascending expenses.

Luckily for us, your own 401(k) includes good results you to definitely almost every other old-age profile cannot – the 401(k) loan. While this option becomes an adverse hiphop every so often, it can be beneficial in the long term should you choose they accurately.

Continue reading knowing the newest five explanations why to obtain an excellent 401(k) loan in addition to regulations inside so you can select when it is your best option for your requirements.

What is actually an excellent 401(k) financing?

An effective 401(k) try a tax-advantaged account install by the employer to conserve to have senior years. You create pre-income tax benefits for your requirements to lower their taxable earnings for the today’s. In exchange, your money develops income tax-100 % free, and you will people income you will be making try reinvested, allowing you to construct your possessions thanks to compounding.

If you find yourself 55 and you may retired, otherwise age 59 ?, you could withdraw the money and no penalties, but you’ll need to pay fees for the taken matter. Thus remember your 401(k) as a family savings that you can not contact in the place of punishment.

A position will get arise in which you you prefer currency, however, bringing a traditional mortgage isn’t feasible. Therefore, you are capable sign up for financing facing your own 401(k), which you are able to pay off which have attention identical to a typical loan – but you would certainly be credit out-of on your own.

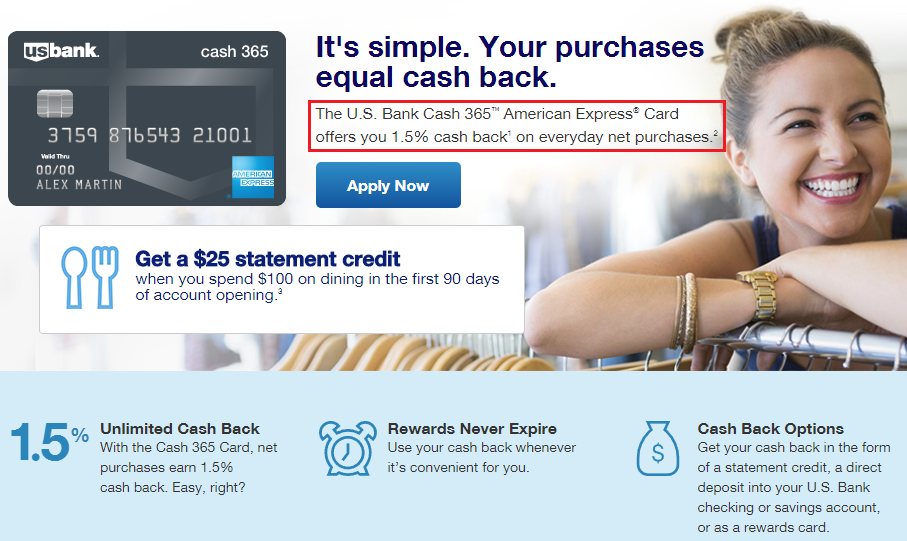

401(k) funds was tempting because they’re quick and simpler. Given that you happen to be credit off yourself, there isn’t any credit assessment and no app. Your bundle administrator often decide the payment selection, that could include payroll deductions.

Just like a classic financing, you are able to spend attention, although 401(k) financing interest rate may be somewhat better than what exactly is provided by a financial. The main benefit of an excellent 401(k) mortgage is you is using one to notice so you’re able to yourself alternatively than a bank. So, in a way, that money isn’t shed.

To help keep your old-age anticipate tune while you are trying to repay the loan, still generate regular 401(k) benefits, especially if your boss now offers a share meets. Some 401(k) preparations could possibly get limitation manager benefits – if you don’t your contribution – toward span of the borrowed funds.

This new variables of every 401(k) are different. Particular may require spousal acceptance for finance, while some do not. Someone else might only bring loans when you look at the specific activities, though some will most likely not succeed 401(k) financing whatsoever.

You can find most certain regulations and rules on the 401(k) loans, if in case your break all of them, you might deal with steep charges.

4 preferred reasons to sign up for good 401(k) financing

Money out of your 401(k) are best for times when you deal with a life threatening that-date consult, like a health bill you to was not covered by insurance policies or a lump sum dollars percentage toward something similar to large-notice credit card debt.

Some 401(k) agreements have very specific recommendations in the when a free account manager is also pull out a great 401(k) financing, so consult your bundle manager before starting the borrowed funds process.

step one. Getting currency down on property

One of the largest hurdles to buying your first residence is coming up with a deposit. Extremely mortgage loans wanted 20% down, and with the escalation in americash loans Brookwood home prices, which may be unrealistic for many individuals. If you are basic-go out homebuyer financing enables you to put down a substantially less deposit, you’re going to have to pay even more charge eg private mortgage insurance coverage (PMI).

Should you want to set-out 20% toward a mortgage loan to prevent PMI, you might financing it having a great 401(k) loan. You may also pull out good 401(k) loan to fund closing charges or the will set you back to help you upgrade or resolve your family (provided this is your no. 1 home).

Even though you need to pay really 401(k) financing right back within this 5 years, you are able to negotiate a longer repayment schedule when playing with 401(k) funds to order a home. Be aware that funding all your valuable family pick using your 401(k) is sold with high drawbacks since you is not able to write off of the focus on your own fees like you you will having a great real estate loan.

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!