Finance to help with Customers Which have Judge Assistance and you will User Education

The amount of money, that happen to be given compliment of FHLB Dallas user Very first Federal Financial out of Louisiana, could be used to let neighbors obvious heirship otherwise title items on their attributes and you will safe a could.

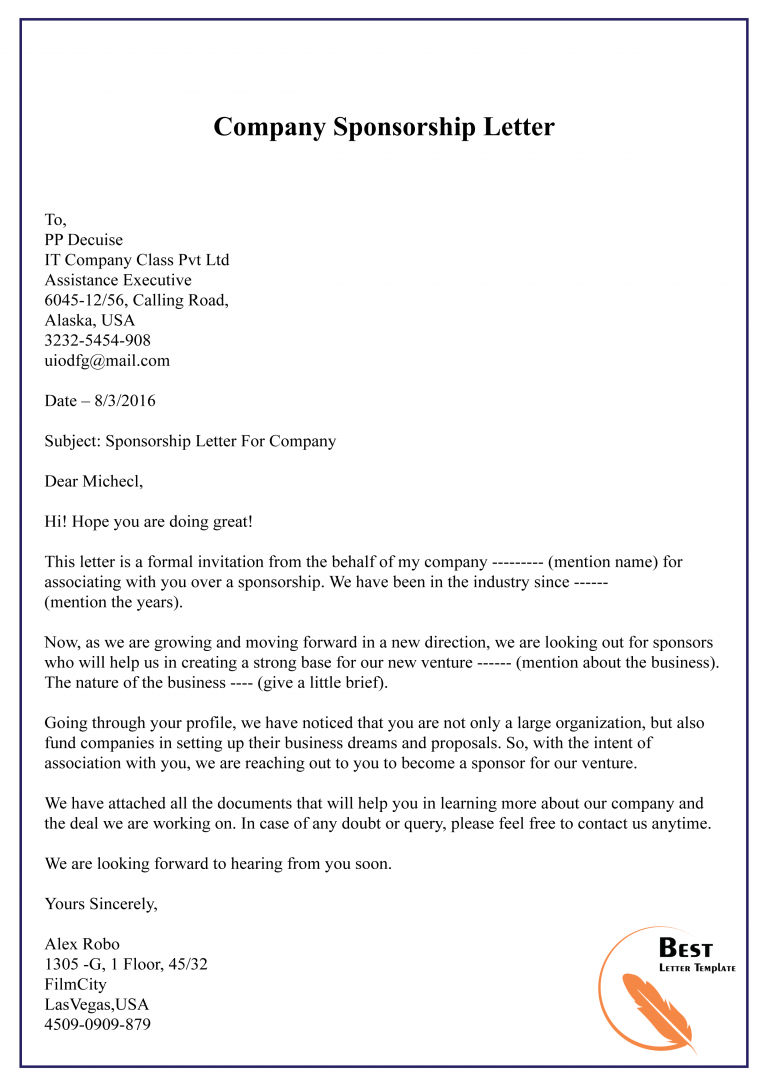

CRA Director Melissa Dickson of First Federal Financial from Louisiana (Left) presents an excellent $75K ceremonial look at under FHLB Dallas’ Heirs’ Possessions Program to Administrator Manager Charla Blake off Endeavor Generate a future (Center) and you may Administrator Director Genia Coleman-Lee of Southwestern La Rules Cardio.

Heirs’ property describes assets inherited in the place of a can otherwise judge papers off possession. Due to the fact property is passed down, for every single straight generation generally leads to a lot more heirs becoming added to this new inheritance. Its lack of a deed or often causes it to be significantly more challenging to find a very clear label in order to residential property otherwise homes once the time seats.

River Charles, Louisiana-mainly based PBAF tend to allocate $50,000 to Southwestern La Rules Cardio (SWLLC) when it comes to lead client advice. The remainder funds might possibly be always carry out academic situation having public information coaching.

Uncertain titles towards residential property and you may possessions is actually a huge state when you look at the this element of Louisiana, particularly in the lower- so you can modest-income inhabitants, told you Charla Blake, executive manager out-of PBAF. By cleaning the latest term, this choice support anyone who has worked hard to invest in and individual their homes bequeath its possessions, obviously and you may legitimately, due to the fact generational riches.

Repeated hurricanes have damaged of a lot Louisiana features, and you will too little funds to possess solutions or difficulties with insurance coverage organizations stands reconstructing, pressing of several residents to move around in. If you are PBAF qualifies and you can matches those with financing, this new SWLLC offers legal advice and help someone secure the label towards the features.

While the attorney functioning in the smaller fees, the funds covers brand new center can cost you sustained in the act, enabling me to flow services with the heirs and you can provide Louisiana owners back into their organizations, said Genia Coleman-Lee, government movie director of SWLLC. These funds offer more than just accommodations; it let anyone return home.

A partner once the first days of PBAF, Earliest Federal Lender from Louisiana is obviously on the lookout for a means to grow their relationships.

Partnering which have Endeavor Make a future while the Southwest Louisiana Legislation Focus on the newest Heirs’ Assets System empowers members of our people to produce a far greater the next day for themselves and you can generations to come, told you Very first Federal Financial away from Louisiana’s CRA Director Melissa Dickson. It shows all of our try to let our organizations build due to homeownership and you can monetary exercise.

We are happier you to definitely users such First Federal Bank out of Louisiana are using the applying to greatly help their groups generate a safe future by the paying down heirship things, told you Greg Hettrick, elder vice president and movie director out-of Area Funding within FHLB Dallas

From the within the financing round, communities you will found as much as $75,000. Awardees included reasonable construction relationships, community creativity groups, courtroom help communities and an excellent university. During the 2024, FHLB Dallas has increased the allowance to help you $2 mil with organizations eligible to discovered up to $100,000 for each and every.

I am happy you to definitely a bank as large as FHLB Dallas very pays attention so you can their representatives and offers on the requires of all the organizations it caters to, said Ms. Blake. New Heirs’ Possessions Program was created for all of us having demands acquiring or thriving in order to qualities and it’ll truly let nonprofits and you can some body living in smaller or outlying teams.

Next app window into Heirs’ Property System honours reveals September step 3 and you can closes to your Sep 30. Users should be inside the FHLB Dallas’ five-county District of Arkansas, Louisiana, Mississippi, This new Mexico or Texas and you may meet the program’s requirements. All of the fund was paid courtesy a keen FHLB Dallas member place.

Regarding Earliest Government Bank out of Louisiana Basic Government Lender off Louisiana is a complete-service, in your area owned people bank that has helped make the newest organizations i serve for more than 70 ages. Having 16 organizations already helping multiple parishes across the Southwestern and you will Central Louisiana, it’s got customers comprehensive merchandising and you will industrial issues together with financial investments and you can insurance coverage functions to satisfy all their monetary means. Head to ffbla.lender to learn more. Associate FDIC, Equivalent Construction Lender.

River CHARLES, LOUISIANA, – The brand new Government Home loan Bank from Dallas (FHLB Dallas) keeps given good $75,000 Heirs’ Possessions Program offer to Endeavor Make a future (PBAF)

Concerning the Federal Financial Financial regarding Dallas The fresh Government Household Financing Lender off Dallas is one of 11 region banks for the the newest FHLBank System developed by Congress inside 1932. FHLB Dallas, having overall possessions from $128.step 3 mil since , try a member-owned collaborative you to definitely supporting homes and you may society creativity by giving well priced financing or other borrowing from the bank facts to help you around 800 participants and relevant establishments into the Arkansas, Louisiana, Mississippi, The new Mexico and Texas. For more information, head to the web site during the fhlb

About Enterprise Make another Opportunity Create the next (PBAF) is a great nonprofit corporation invested in exciting the address town by way of high quality, sensible home-control effort. Its target area encompasses the fresh areas Northern from Large Highway for the Lake Charles, Los angeles. Additionally, PBAF now offers homebuyer counseling characteristics you to put a powerful foundation to possess monetary popularity of homeowners and therefore improves their capability to be successful along side long-term. In reality, PBAF possess seen zero property foreclosure with the any kind of its homes once the the inception during the 2001.

Regarding the Southwestern La Rules Cardiovascular system New Southwest Los angeles Laws Center (SWLLC) try a beneficial More compact Function firm that gives affordable judge assistance to those people people which do not qualify for free legal services. A moving percentage size is employed to find the cost to have icon. Legislation Cardiovascular system might have been serving the new underprivileged organizations out-of Southwest Louisiana just like the 1967 which have quantifiable triumph consequently they are happy with this new strong heritage away from brilliance, making sure only the best value from service to help you readers.

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!