Debt consolidating which have property Security Loan: Is-it Right for you?

Struggling with debt and racking your brains on how exactly to tackle it? You are not by yourself. The average Western household owes almost $100,000 indebted separated ranging from sources such car and truck loans, personal credit card debt, student loans or personal loans, which all of the bring some other interest levels. One method to reduce one personal debt weight is to try to consolidate they which means you pay using one mortgage instead of multiple. If you individual a home, it can be done using a property collateral financing.

What is actually Family Security and how Might you Have it?

Domestic guarantee shows the degree of your property that you own rather than personal debt. As an instance, in the event the residence is worth $five hundred,000 and also you are obligated to pay $200,000 on your home loan, then you have $3 hundred,000 of collateral.

You can obtain doing 100% of your own house’s well worth*. Following financing closes, you will get the cash in a lump sum payment and you may quickly begin repaying interest. These loan differs slightly from a home guarantee range away from borrowing, where in actuality the currency your use comes into a merchant account and you also merely shell out notice on which your withdraw.

Just how Paying Obligations which have a house Collateral Mortgage Functions

You should use your property guarantee mortgage lump sum payment to expend off almost every other expense, merging the amount you borrowed from lower than one to lender with just one interest. The speed for a house collateral loan is commonly less than cost for other financing. As an example, our very own fixed home security financing rate is really as reduced as the 5.99% APR**, while mastercard rates of interest are twice or multiple that price.

Here’s how playing with family guarantee to repay financial obligation can work. Say you take out an effective $50,000 HEL that have a beneficial 5.99% price. You could pay off your education loan from $25,000 with an excellent % rate, the mastercard costs regarding $5,000, along with your car finance out of $20,000 that have a six.9% rate-and lower your rate of interest.

The huge benefits and you can Cons of using a property Collateral Financing getting Debt consolidation

- Simplifying your debt commission with one to monthly payment

- Putting on a lower interest rate

- Paying down personal debt less

- Potential for highest financial obligation load for individuals who continue racking up credit credit costs

- Protecting that loan with an asset such as your domestic usually gifts a loans Valley AL threat

Who’s So it smart To own?

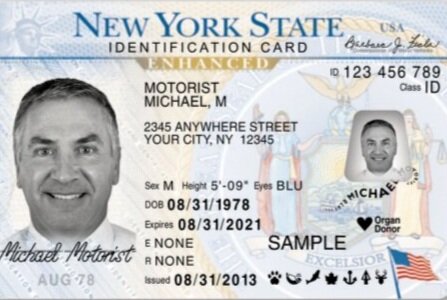

You should own a home to use which debt rewards means. In addition need provides a serious risk in the home, along these lines partners whom used their HEL, so you can be eligible for a property collateral loan. And you will have the ability to create into the-go out money and that means you dont rack up late charges and you will dive subsequent to your loans.

*100% money is obtainable for the an excellent priple terms and conditions: For those who borrow $29,000 from the % Apr for a beneficial 20-year name, the projected monthly payment are $. Most other limits otherwise requirements will get incorporate. Rates is susceptible to change without warning. Speak to your tax advisor for taxation deduction advice.

**Apr = Annual percentage rate at 80% mortgage to help you worthy of. Rates active ount regarding $5, becomes necessary. $5, in the money is called for when refinancing an existing People 1st Home Collateral Loan. Sample terms: For people who obtain $29,000 at the 5.99% Annual percentage rate getting an excellent 10-season label, their estimated monthly payment may be $. If you use $31,000 on 6.74% Annual percentage rate to possess a good 15-12 months term, your projected payment per month may be $. Interest levels derive from creditworthiness and your house’s financing-to-worthy of. Primary house only. Property insurance is expected. Pennsylvania and Maryland residences merely. For non-players, you’re going to be required to signup Members first to get to know eligibility standards.

Make use of Residence’s Collateral

As domestic guarantee money render down interest rates than many other sort of fund, they may be a simple way to help you combine higher-attention obligations. Pertain online and all of us tend to reach out to comment your own solutions!

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!