Martingale Exchange Means: Video, Laws and regulations, Settings, Backtest

Posts

- What kinds of places are a great Martingale strategy most commonly made use of?

- Applying the brand new Martingale Strategy in different Gaming Scenarios

- The brand new Martingale EA: A risky, But really Effective Method

- ‘s the Martingale program like the newest double-off approach?

- Just how can buyers manage risk when using the Martingale method?

The newest Martingale strategy is tend to based on the expectation that the odds of achievement inside the a trade try 50%, and this isn’t usually correct. Appropriately, the fundamental challenge with the brand new Martingale experience short wins which have occasional higher losings. Simply click Spot Martingale trade robot and pick your chosen exchange function.

What kinds of places are a great Martingale strategy most commonly made use of?

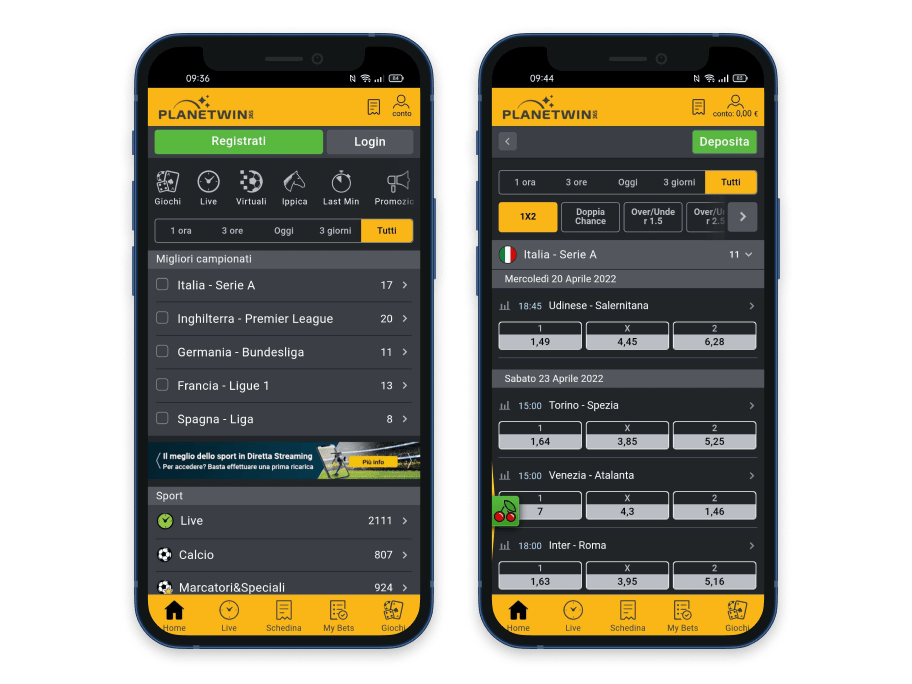

Such systems make it investors so you can program its exchange spiders to perform the brand new Martingale strategy, increasing the positioning dimensions after each loss and you can resetting immediately after an excellent win. Consequently, the fresh individual minimizes their change size by the one tool after each and every victory, based on the belief that each successful exchange adds you to definitely equipment more the very last change forgotten. This method is fantastic for people which like not to chance large amounts or chase loss, permitting steady development lined up with industry trend.

Applying the brand new Martingale Strategy in different Gaming Scenarios

- A major worldwide monetary downtrend will devalue the cost of the particular currency although not to zero accounts.

- You opt to remain in the brand new trading and twice the trading proportions so you can $20, still longing for lead 1.

- This helps manage a consistent approach and you may inhibits the methods away from rising unmanageable.

- Bettors was attracted to the brand new appeal from a playing program you to assured uniform earnings.

- By doing so, i restriction our potential funds or loss so you can equivalent quantity.

Another issue is that it’s likely that usually not equivalent to have gamblers and traders — an excellent martingale program don’t be winning which have an excellent possible opportunity to winnings lower than 0.5. In roulette, red otherwise black colored has only an excellent 18/37 possibility to victory (on account of zero); in The forex market, you will find a broker’s spread, which shifts the new opportunity against the individual. Of several gamblers hardly understand one to just one wrong play is prices them tons of money. In theory, everything you tunes possible, but it’s harmful when put on genuine-industry situations and real game. And, not everyone and it has the mandatory investment to twice down repeatedly.

As stated before, the new Martingale strategy sells built-in risks, so it is important to very carefully ensure that you look at the performance just before deploying it inside the real time trading. Thus the fresh EA can also add on the change several times, sense reversals, and regularly personal deals at a loss. The newest Martingale method will be right here, also it’s important to comprehend the effects. My travel on the Martingale EA began while i filed two video from the a $ten robot I bought on the marketplace. Just after evaluation they to the a demonstration be the cause of more thirty days, We observed which produced a great funds playing with Martingale beliefs. Yet not, I happened to be not entirely fulfilled while the robot lacked visibility inside the terms of the underlying means.

It is essential to possess buyers to carefully think about the problems and advantages of employing the brand new Martingale method before applying they in the their change. Even when one another actions features their particular pros and cons, it’s imperative to influence the very first factors for your self while the there isn’t any you to definitely-size-fits-the method. Think of, successful exchange isn’t just in the strategy; it’s along with in the abuse, perseverance, and you may persisted discovering. Thus, the newest trader succeeded in the first trade, doubled the status size, and forgotten in the next trading. Up coming, the brand new trader halved the condition proportions and, on the second exchange, destroyed 2% of the balance. In the last exchange, it risked only one% of one’s equilibrium but succeeded.

The brand new Martingale EA: A risky, But really Effective Method

The new hypothetical best situation for it strategy was a professional https://mrbetlogin.com/jack-on-hold/ bull industry. It might theoretically as well as work in the momentum change as the, with increased buyers in the business, the cost of the protection provides supposed high. Of course, simply to repeat one more time, this is all the hypothetical.

‘s the Martingale program like the newest double-off approach?

The fresh martingale system (also known as the brand new martingale approach) are a risk-looking to kind of investing. Believe permitting the fresh behind stop feature, and this adjusts the fresh stop-losses level because the change motions on your side. This permits one to capture earnings when you’re supplying the exchange room to inhale.

I have moved on it earlier, but generally a predetermined fractional model have a tendency to limit risk so you can an excellent preset risk percentage to your any given trading. Some traders will find that it getting a little while conventional, yet not, typically, it includes to find the best blend of upside possible and you will minimal chance of damage condition. First of all, it decreases the drawdown risk as opposed to amplifying it as are trait away from Martingale steps. Extremely educated people realize that probably one of the most important elements in order to victory in the market try a trader’s capacity to perform risk. The brand new Anti-Martingale system has established-in the components to possess reducing exposure for each and every change, which means that at some point decreasing the threat of destroy of your own change membership.

The new Anti-Martingale strategy is felt a shorter risky means since it reduces the risk for every change and eventually decreases the threat of shedding money. They assumes on you take advantage during the expansive progress, and is also thought a far more standard and you can logical currency-management design. Part of the problem with this procedure are getting enough supply of money, as it might bring more than a few investments one which just money. For many who lack financing ahead of that occurs, you will see missing everything.

A trader which spends the brand new martingale method must also provides a great high-risk threshold and also deal with the newest psychological worry you to definitely has high losings. The new Martingale strategy is a likelihood theory that was introduced by Paul Pierre Lévy, a good French mathematician in the 1934. The concept wasn’t titled up until 1939 whenever Jean Ville created the phrase “Martingale”. The fresh Martingale means inside a nut-shell ‘s the faith that you can have one a great choice otherwise change to make their fortunes as much as and get away from losings.

Just how can buyers manage risk when using the Martingale method?

The fresh Martingale Method is a way buyers you will need to make money because of the increasing the change dimensions on every losses, dreaming about an eventual win. Because the strategy is designed to recover losses with every profitable trade, it hinges on the belief that the investor has a limitless way to obtain investment and this the market at some point turn in their choose. Indeed, there isn’t any ensure that a fantastic trade will occur, and you will consecutive dropping investments can certainly exhaust the new investor’s balance.