Cash Budgets Problems and Solutions Group sort

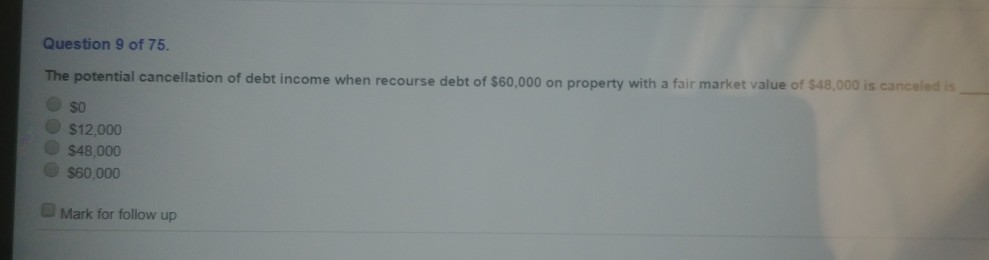

Also, the management may plan to repay part of its debt and reduce its interest burden during periods with a cash surplus. If you are paying down have multiple accounts and the sum of the monthly payments is more than you can afford, consider consolidating the debts into one account with a lower monthly payment. For credit cards, you might be able to transfer balances. For more complex situations, you might need to look into a debt consolidation service. A company produces component A which is used in its normal production.

This keeps communication open and helps prevent problems from starting again. You also can contact your creditors and utility providers and see if they are willing to change the due dates on bills. Some companies might be willing to work with you so you can distribute due dates more evenly throughout the month.

A representative of the local high school recently approached Tony to ask about a one-time special order. The high school will be hosting a state wide track and field event and is willing to pay Tony’s T-shirts GH¢ 17 per shirt to make 200 custom T-shirts for the event. Because enough idle capacity exists to handle this order, it will not affect other sales. That is, Tony has the factory space and machinery available to produce more T- shirts.

Is Hindenburg Report True Regarding Accounting Fraud of Adani Company

The more seasonal or uncertain position of a business leads to a more frequent the cash budget is prepared. A cash buffer is essentially a financial safety net for your business. To determine how much cash buffer your business needs, you’ll divide cash balances by cash outflows. This will tell you the number of days that your cash on hand will be able to make up for no incoming cash flow. Prepare the expected cash payment schedule for direct material purchases iii.

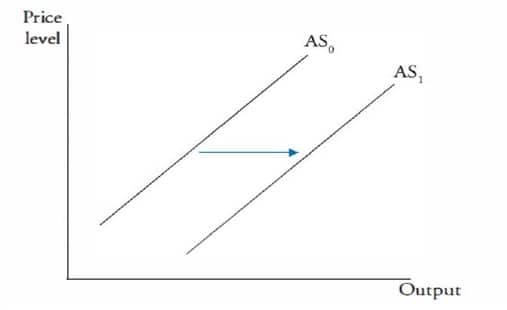

Short-term cash budgets focus on the cash requirements needed for the next week or months whereas long-term cash budget focuses on cash needs for the next year to several years. A cash roll forward computes the cash inflows and outflows for a month, and it uses the ending balance as the beginning balance for the following month. This process allows the company to forecast cash needs throughout the year, and changes to the roll forward to adjust the cash balances for all future months. For several reasons, it’s crucial to have a monetary budget.

Now if the total of estimated liabilities is more than the estimated assets, then the balancing figure is closing cash and cash equivalents. A cash budget is an estimation of the cash flows of a business over a specific period of time. This could be for a weekly, monthly, quarterly, or annual budget. This budget is used to assess whether the entity has sufficient cash to continue operating over the given time frame.

Automate invoicing, bank transfers, and payroll to better align with the varied schedules. Generate some forms of passive income to compensate for a reduced income stream, or even fund some of your other business growth. Use a receipt scanning app to take a picture of receipts with your phone and upload them to your account. If you find it hard to resist charging your credit card, lock it up in a safe space rather than carrying it in your wallet.

How to Easily Track Small Business Financials

DepreciationDepreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. Its value indicates how much of an asset’s worth has been utilized. Depreciation enables companies to generate revenue from their assets while only charging a fraction of the cost of the asset in use each year. A budget is an estimation of revenue and expenses over a specified future period of time and is usually compiled and re-evaluated on a periodic basis. The company may want to build out all these aspects to meet demand, but if it doesn’t have enough cash or financing to be able to do so, then it cannot.

The idea of this method is to calculate the present value of cash flows. The cost of a project is $50,000 and it generates cash inflows of $20,000, $15,000, $25,000, and $10,000 over four years. It’s a common sighting that cash flow problems are a primary reason why small businesses fail. • The cash balance at the beginning of Quarter 1 is estimated to be $49,400 positive. The cash balance at the beginning of Quarter 1 is estimated to be $49,400 positive. Variable overheads amounted to GHȼ260 and fixed overheads amounted to GHȼ730.

During the coming period, the company is considering whether or continue the manufacturing of the component or buy it from external source. Manufacturing of the component is in batches of 10,000. The bought-in- price quotation received from the external supplier is GH¢8 per component.

Calculate the return on investment for both before pizza is added, for the pizza project only, and for the units after expansion. Calculate residual income for both units before and the potential expansion assuming a 14%cost of capital. Prepare the cash budget by the month and in total for the first quarter of 2015. The average collection period of the company is half a month and credit purchases are paid off regularly after one month. The future cash availability of the business can be known for availing discounts from the vendors on timely payment of cash.

- There are a number of ways to solve this issue; it really boils down to why you’re not seeing any sales.

- This in turn helps the company to grow and increase its profitability.

- At the beginning of 2015, a business enterprise is trying to decide between two potential investments.

- A cash budget is an estimation of the cash flows of a business over a specific period of time.

- The cash receipts include all of a business’s cash inflow of a given period.

There are a number of ways to solve this issue; it really boils down to why you’re not seeing any sales. Online businesses might look at their Google Analytics or conversion software, whereas a freelance photographer might consider implementing a referral program with incentives. Start by identifying your future business goals and determining your needs from there. While that growth is great for your bottom line, you may also face some growing pains along the way, with cash flow being just one of them.

What is Cash Budget?

Do you want to further test your knowledge about budgeting? Plant and machinery are to be installed in August at a cost of $24,000. This sum will be paid in monthly installments of $500 each from 1st October. The cash and bank balance on 1st October is expected to be $1,500.

A cash budget acts as a tool to correctly time expenditures of the company as per its cash resources. Also, as said earlier, it gives the management time to be prepared for utilizing surplus cash when available. This results in building goodwill and brand value of the business. This in turn helps the company to grow and increase its profitability. Preparing the budget will take into consideration all the probable cash outflows during the budget period. This budget takes into account all the probable sources from where the company can earn cash over the budget period.

However, credit card companies typically charge a fee to merchants that use their service, so you’ll need to weigh those costs against the benefits of quicker payments. Moreover, managers can know in advance the periods with a cash surplus. Sitting over idle cash can lead to a waste of an investment opportunity. It can result in missing out on handsome profits for the company.

And in many cases, it’s a combination of both controllable internal challenges and unavoidable external ones that can work against your sales goals. Open a line of credit to make purchases and preserve your cash on hand. As entrepreneurs, we all have a fear of running out of money and having cash flow problems. The absence of a “predictable paycheck” is scary, but the rewards of owning your own business far outweigh those risks. A production budget showing the number of units to be manufactured each month. Overcoming the challenges of budgeting can help you stick with your budget and help you manage your money successfully.

Business owners love Patriot’s award-winning payroll software. Inefficiency of the management and that the business situation is negative. At the beginning cash budget problems and solutions of 2015, a business enterprise is trying to decide between two potential investments. According to the payback method, Machine A is preferred.

Moving forward with curbing your cash flow problems

A company produces three products A, B and C all of which passes through the same finishing process. For the coming month, the number of hours available in the finishing process is 6,000 hours. The space being used to produce the milk jugs could be used to store empty jugs, eliminating a rented warehouse and reducing common fixed costs by 20%. The rest of the space could be rented to another company for GH ¢30,000 per year.

As you make more money, you also have to spend more money to run your business. Your overhead could increase because you’re outsourcing more, you need to hire more employees, you have to upgrade tech tools to higher plans, or you need to invest in more inventory upfront. Paying attention to your cash flow and tackling challenges head-on is a great way to make sure you always have the funds you need to stay in business. Below, let’s look at how you can be proactive in maintaining healthy cash flow for your small business.

What Are the Steps of Creating a Cash Budget?

Cash budget is just estimation of cash payment and receipt of cash. But when you act upon on this cash budget, it will become the part of your accounting. In first cash, if you have paid 70% of total purchase within 30 days. So, in case within 30 days payment, purchase expenses will be added our that financial year as expense not o/s expense. If it will be paid 30 days after, we will show 70% of goods purchase expenses as O/s expenses.

You are required to prepare a cash budget for each of June, July and August. The main purpose of a cash budget is to help manage incoming and outgoing cash flow to make informed decisions about how best to utilize its resources. Cash and bank balance on April 1 was $15,000, and the company aims to keep it below this figure at the end of every month. From the information below, prepare a cash budget for a company for April, May, and June 2019 in a columnar form. From the information below, prepare a cash budget for the period from January to April.

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!