Why does an ICICI EMI Calculator Functions?

What’s the ICICI EMI Calculator?

EMIs, otherwise Equated Monthly obligations, offer a structured and you will reliable approach to paying off the fund, empowering one achieve monetary versatility. These fixed monthly obligations defense both the dominant loan amount loan places Joppa and you will the interest charged by bank. By paying your EMIs daily, you slowly decrease your a fantastic mortgage balance along the decided mortgage tenure up until the whole personal debt try completely paid.

Regarding financing fees, and come up with informed conclusion is vital. On the ICICI EMI calculator, you can try out some mortgage quantity, rates, and tenures to discover the best balance one aligns with your financial needs.

If you’re planning for taking financing away from ICICI Bank, look no further than the fresh Angel You to ICICI EMI calculator. Which calculator makes it possible to effortlessly determine their monthly repayments. Whether you are provided home financing, car finance, consumer loan, and other loan sorts of, the web ICICI EMI calculator was a very important financing to have accurately estimating the EMIs.

The latest Angel One to ICICI EMI calculator operates into the a simple algorithm based on around three priount, the rate, together with tenure. From the provided such affairs, brand new calculator rapidly works out the EMI number you may be needed to expend per month.

The way you use the fresh new ICICI EMI Calculator On line?

The fresh Angel One to online ICICI EMI calculator often quickly guide you the new EMI payable. You might adjust the loan amount, rate of interest, otherwise tenure to explore different combinations and get the most suitable cost plan for your circumstances. Let us comprehend the more than actions which have an illustration. Guess your mark a loan amount from Rs. 70,000 at eight.40% to have 36 months. Upcoming, as per the ICICI EMI calculator, you will need to pay a keen EMI regarding Rs. 2,174. The quantity you are going to need to pay off is Rs. 78,272.

Products impacting the newest ICICI Lender EMI amount

- Loan amount: The total amount you obtain individually affects the EMI. Highest loan numbers lead to large monthly installments.

- Rate of interest: The rate put on your loan influences the complete payment. Highest interest rates result in higher fees numbers and you can EMIs..

- Tenure: The newest payment stage you decide on for the financing in person affects for each instalment matter. Prolonged tenures essentially bring about faster EMIs, nonetheless they boost the full appeal for the mortgage.

Advantages of choosing an ICICI Financial EMI Calculator

- Finest monetary planning: With a very clear image of the EMI, you could potentially assess how much cash you should spend some each month to have financing installment, working for you budget most readily useful.

- Instant results: New calculator provides accurate EMI number within a few minutes, ensuring reputable calculations to suit your mortgage costs. You don’t have to have confidence in tips guide computations or guesswork.

- Advised decision-making: The brand new calculator are often used to evaluate loan choices. You could potentially try out various loan amounts, rates, and you can tenures to obtain the most affordable solution that fits their economic wants.

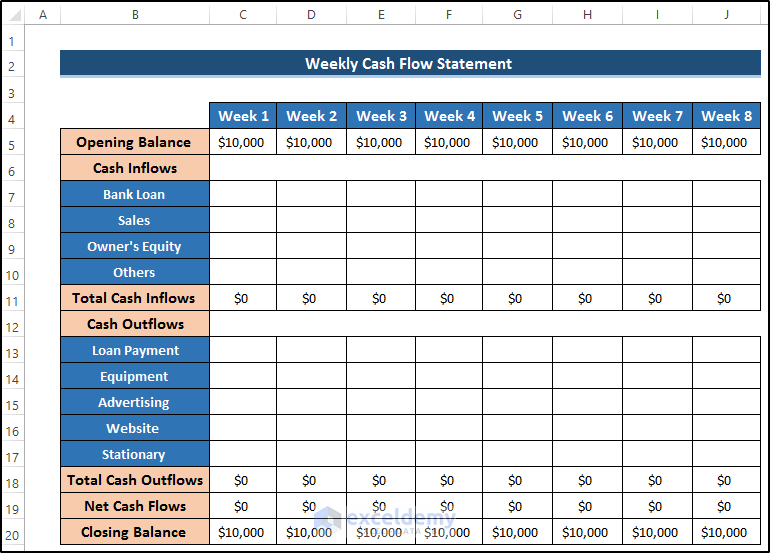

- Visualize cost excursion: The fresh new EMI calculator has got the month-to-month EMI number and offer your an overview of your loan cost excursion. They stops working the eye and you may principal components, working out for you know the way your instalments subscribe to reducing your a good equilibrium throughout the years.

Sort of Loans Supplied by ICICI

- Cardless EMI: With ICICI Lender, you can easily move your purchases towards the monthly payments without needing an actual physical credit otherwise debit card. This will be a no-prices EMI alternative definition you do not spend people desire into financing.

- Mortgage: ICICI Bank also provides a selection of financial products which cater to different requirements, regardless if you are to order yet another assets or refinancing a current you to.

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!