As to the reasons your credit score is very important for finding home financing

Borrowing utilization is where much credit you are using compared to the exactly how far you have available. When you yourself have $ten,000 found in borrowing from the bank, and you’re having fun with $9,000 of this while paying the lowest monthly, it does damage the get.

step 3. Amount of credit rating (15% of one’s credit history)

Regrettably, for those who have a sparse if any credit history, it can harm their rating. The credit bureaus want to see a lengthy reputation for borrowing so they are able size how constantly you manage your costs more than time.

cuatro. Combination of borrowing (10% of one’s credit score)

The credit bureaus together with want to see variety on your own borrowing from the bank record, definition you have demonstrated to pay back several different forms out of debt immediately (car repayment, bank card, student loan, mortgage).

Definitely, being overburdened in debt you can’t afford would not let their rating. However, if you will be consistently repaying several costs at once, your score is going to be more powerful because of it.

5. The new borrowing (10% of your own credit rating)

As soon as you accept new personal debt otherwise a credit line, your own rating will drop for a period (after which, it has to in fact boost in the long run thanks to the combination of borrowing from the bank role installment loans in Bolton MS with bad credit above).

Thanks to this you should stop and also make one big commands otherwise taking out fully people the fresh new personal lines of credit when you are house hunting – you really need to have every point you’ll be able to to your benefit in order to rating an excellent home loan speed.

The characteristics try twofold: You’ll want to fulfill a specific minimum credit history requirement in order to end up being approved getting a mortgage to start with. And on better of that, their rating often impact the mortgage speed you are offered, and this affects how much you’ll be able to pay money for your own mortgage.

The better credit history you may have, the greater speed you’ll get therefore the less exposure you are, Carteris shares.

Lenders need to know that you’ll pay them back. A demonstrated ability to make ends meet punctually plus full each month provides your own financial trust that you’ll also pay the financial in full as well as on time per month.

Consumers having countless 740 or higher (known as those in the fresh new FICO Very good borrowing from the bank pub) commonly be eligible for the best costs a loan provider needs to bring. And therefore form protecting a lot of money on your mortgage throughout the years!

How to locate out your credit score

At this point, you’re probably delivering fairly interested in learning your credit score and how you will be faring according to FICO. There clearly was good news and you will bad news.

Luckily, every People in the us have the right to one to free credit history for every season from the three bureaus. There are yours on AnnualCreditReport – the actual only real government-approved webpages at no cost credit file.

These free reports will give you invaluable details about the credit history, and they’ll show you as you make improvements must purchase property.

Now let’s talk about the fresh bad news: These credit file wouldn’t show their FICO score. They will certainly show when the you can find people bad credit occurrences impacting your own score (you will likely need to augment this type of before you apply for home financing), but when you want your own actual FICO rating, you will need to search better.

You could potentially pay to really get your FICO get thanks to a 3rd party retailer, however, you will find 100 % free an approach to availableness that every-essential count also!

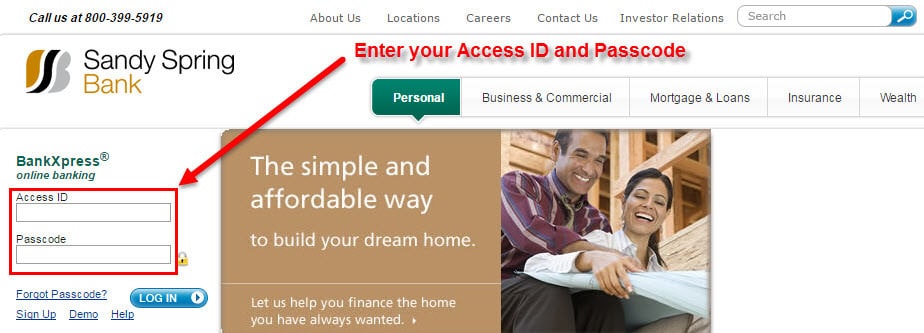

One of the ways you’re able to get their FICO get free of charge is by using the lender or loan company, because of the FICO Discover Availability System. For those who already play with a major financial institution such as Citi, Financial from The united states, Look for, otherwise Wells Fargo, you could potentially probably get a free of charge FICO score now.

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!