Below i’ve noted a few of the most prominent FHA Mortgage Q&A

Every day i discovered many questions about FHA mortgage loans away from potential homeowners. Have you got a question? Call us at Ph: 800-743-7556 or simply just submit the fresh quick info consult mode with loans Fairplay CO this webpage.

A: The latest Federal Property Government (FHA) was a company of one’s government. The brand new FHA ensures individual money awarded for new and you can existing housing, and also for accepted apps to own household fixes. The fresh FHA was made of the Congress when you look at the 1934, and in 1965 turned a portion of the Agency out of Housing and you will Metropolitan Development’s Office off Property, called HUD. New FHA’s purpose in the current go out boasts giving to help borrowers get to the dream of homeownership with lowest bucks coupons. FHA and helps loan providers through the elimination of the possibility of giving loans.

A: Zero, the application means an excellent step 3.5% advance payment. Yet not, Fl very first-big date customers that will be employed by a florida-centered company have the Home town Heroes System offered. Which 2nd financial program lets 5% (up to $thirty five,000) to suit your FHA deposit and you will closing costs. The application form comes with household income constraints, please learn more about the fresh Fl Home town Heroes mortgage here. The newest Florida Home town Heroes direction financing was limited to the state yearly, excite check with united states on the most recent status.

A: The loan insurance fees for FHA mortgage loans (labeled as PMI or MIP) are faster out-of .85% to help you .55% for maximum 96.5% investment financing. Please read more toward 2024 FHA mortgage insurance right here.

Q: I am aware the newest FHA financing need a beneficial step 3.5 % advance payment, do i need to keeps a close relative advice about it? L. O’Neill Western Palm Seashore, Fl

A beneficial. Sure, your loved ones will help lead the necessary down payment and you will/otherwise settlement costs fund. However, the newest present finance have to be recorded of the both the gift donor therefore the current person. Make an effort to talk to your loan specialist just before getting people higher dumps.

FHA Home loan Q&An effective

Q: Is the FHA system just reserved to possess first-time property owners? Let’s say We owned property in past times? K. Falkner -Atlanta, GA

A: Zero, you can now sign up for the new FHA loan, the application isn’t booked for just first-date consumers. However, individuals one currently have an FHA mortgage, and want to retain their residence, will get face extra qualifying demands to the new loan.

A: FHA interest rates happen to be very low, more often than not less than old-fashioned Federal national mortgage association otherwise conforming fund. Since 2023, FHA home loan rates of interest are quite glamorous.

Most FHA Q&An effective

Q: Is not it more difficult to own households so you can be eligible for a keen FHA home loan when compared to a classic home loan? P. Stanford Ocala, Fl

A: FHA provides eliminated the obstacles so you can property being qualified or being compliant having FHA funding. Essentially, in the event that a home is within sufficient updates to help you qualify for a vintage home loan, it is going to be eligible for an FHA home loan.

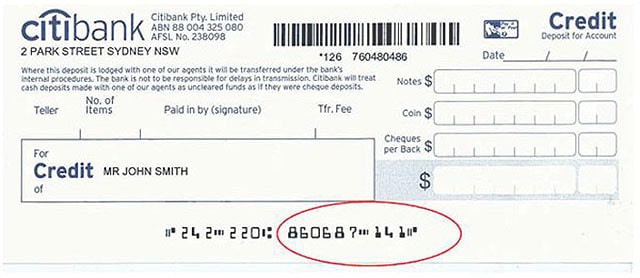

A: E mail us by submission the latest quick demand means on this page, or name Ph: 800-743-7556. Once you do that a loan specialist commonly contact us so you can talk about the techniques in more detail. The complete FHA pre-approval procedure simply takes in the ten full minutes to accomplish. You’ll have first income and you will investment information on hands, this consists of W2, shell out stubs, taxation statements, and you will bank statements.

Just be capable have demostrated employability, jobs stability, and reliability. So it accuracy has holding a steady jobs for around one or two many years with no higher holiday breaks into the work. Any foreclosure in your listing shall be at the least couple of years dated. The same pertains to personal bankruptcy.

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!