Consolidated Financial Statements: Requirements and Examples

On disposal, reclassification ensures that the amount recognised in SOPL will be consistent with the amounts that would be recognised in SOPL if the financial asset had been measured at amortised cost. Available for sale securities are securities that are available for sale (literally!) and have a readily available market price. At the end of each financial year, companies need to value the available for sale securities. Any gains/losses due to the change in valuation are not included in the Income Statement but are reflected in the Statement of Comprehensive Income.

Transform how you see, plan and lead your business

Answer Let’s consider each of the investments in turn to determine if control exists and, therefore, if they should be accounted for as a subsidiary. A typical OT question may describe a number of different investments and you would need to decide if they are subsidiaries – i.e. if control exists. The following income statements have been produced by P and S for the year ended 31 March 20X9. Once any impairment has been identified during the year, thecharge for the year will be passed through the consolidated incomestatement.

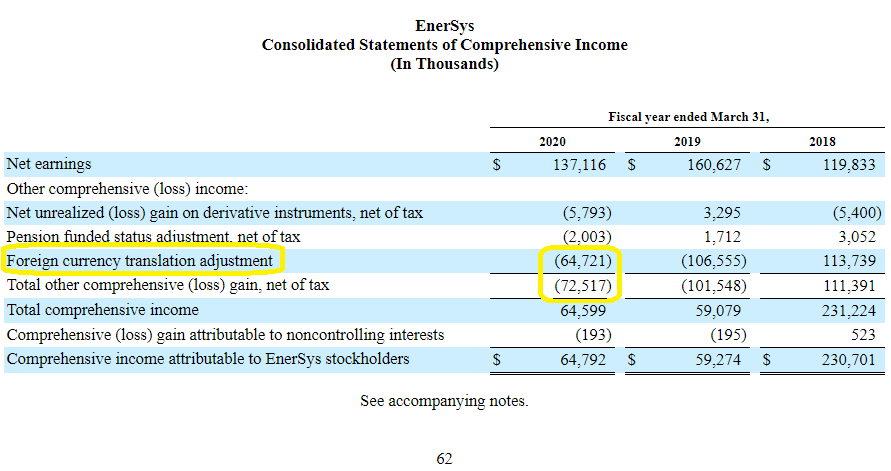

Statement of Comprehensive Income

This approach provides a more comprehensive view of the parent company’s financial performance, reflecting its interest in the profits generated by its subsidiaries, regardless of whether those profits are distributed as dividends. Separate financial statements report the financial performance of individual entities, while consolidated financial statements merge the financial data of a parent company and its subsidiaries into a unified report. Consolidated statements eliminate internal transactions, providing a comprehensive view of the entire group.

Companies with consolidated financial statements

- For fully consolidated statements—where all a subsidiary’s assets and liabilities are rolled into the parent’s statement—there won’t be separate line items showing subsidiaries.

- Set out below are the draft income statements of P and its subsidiary S for the year ended 31 December 20X7.

- For example, gains on the revaluation of land and buildings accounted for in accordance with IAS 16, Property Plant and Equipment (IAS 16 PPE), are recognised in OCI and accumulate in equity in Other Components of Equity (OCE).

- A consolidated financial statement is a group of financial statements of a parent company and its divisions and/or subsidiaries.

- This could be asked as an OT question but is more likely to be a MTQ where you will be calculating and submitting a figure for each of the component parts of the goodwill calculation – cost, NCI and net assets.

- To understand this, we must first pay heed to the opposite of comprehensive income.

Both GAAP and IFRS have some specific guidelines for entities that choose to report consolidated financial statements with subsidiaries. Unrealized gains or losses can make consolidated financial statements inaccurate, especially if they result from intercompany transactions. These adjustments ensure that the financial statements reflect only realized gains and losses from external transactions.

Specifically, it is located under the equity section of the balance sheet as well as under a related statement called the consolidated statement of equity. A revaluation surplus on a financial asset classified as FVTOCI is a good example of a bridging gain. The asset is accounted for at fair value on the statement of financial position but effectively at cost in SOPL. As such, by recognising the revaluation surplus in OCI, the OCI is acting as a bridge between the statement of financial position and the SOPL.

This ensures that a company’s financial data is always clean, accurate, and readily available for reporting. Existing disclosures to either detail comprehensive income and all of its components at the bottom of the income statement, or on the following page in a separate schedule, have made analysis easier. A number of accountants have questioned why OCI is listed as part of equity on the balance sheet, but if you look carefully, there are a number of places to locate it and help determine the health and total economics of the underlying company. Insurance companies like MetLife, banks, and other financial institutions have large investment portfolios. In this respect, OCI can help an analyst get to a more accurate measure of the fair value of a company’s investments. This statement illustrates the changes in equity of the parent company and its subsidiaries over a specific period.

At the end of the statement is the comprehensive income total, which is the sum of net income and other comprehensive income. Comprehensive income is the sum of a company’s net income and other comprehensive income. Concluding exam tips Remember that at FA/FFA level, a good solid platform of understanding the principles consolidated statements of comprehensive income of consolidation is required. IAS 28 also states that a holding of 20% or more of the ordinary (voting) shares can be presumed to give the investor significant influence unless it can be demonstrated otherwise. You should use the range 20-50% of voting shares in the exam as your main indicator of significant influence.

In this question the fair value of the non-controlling interest is given, so in our calculation we just need to add it to the consideration transferred. In a MTQ it is likely you would be given the value of a NCI share and have to apply it to the 8,000 shares that Red Co did not acquire. However, in this particular question, by reading the question carefully you will see that eliminating the unrealised profit was a red herring as we were simply being asked for the consolidated revenue.

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!