Home loan Taxation Positives Explained: Conserve Reasonable Taxation in your Home loan

Delivering home financing from inside the India is pretty effortless but it should be a pricey affair. Yet not, you will find a gold lining so you’re able to it, that is the many taxation pros one can score the year on it, as per the conditions of the Income tax Operate, out of 1961. It Act contains various areas around hence different home loan tax positives are provisioned for home loan borrowers to get.

A property loan has a couple factors: cost of the dominating sum additionally the focus costs. Fortunately, those two qualify for taxation write-offs. When you’re dominating repayment are deductible not as much as Section 80C, deduction to the attention payment try acceptance lower than Part 24(b) of your own Income tax Operate, 1961 loans Salmon Brook CT. Keep reading to learn just how to take advantage of the attention on casing financing deduction getting ay 2023-24.

Income tax Professionals on Mortgage brokers

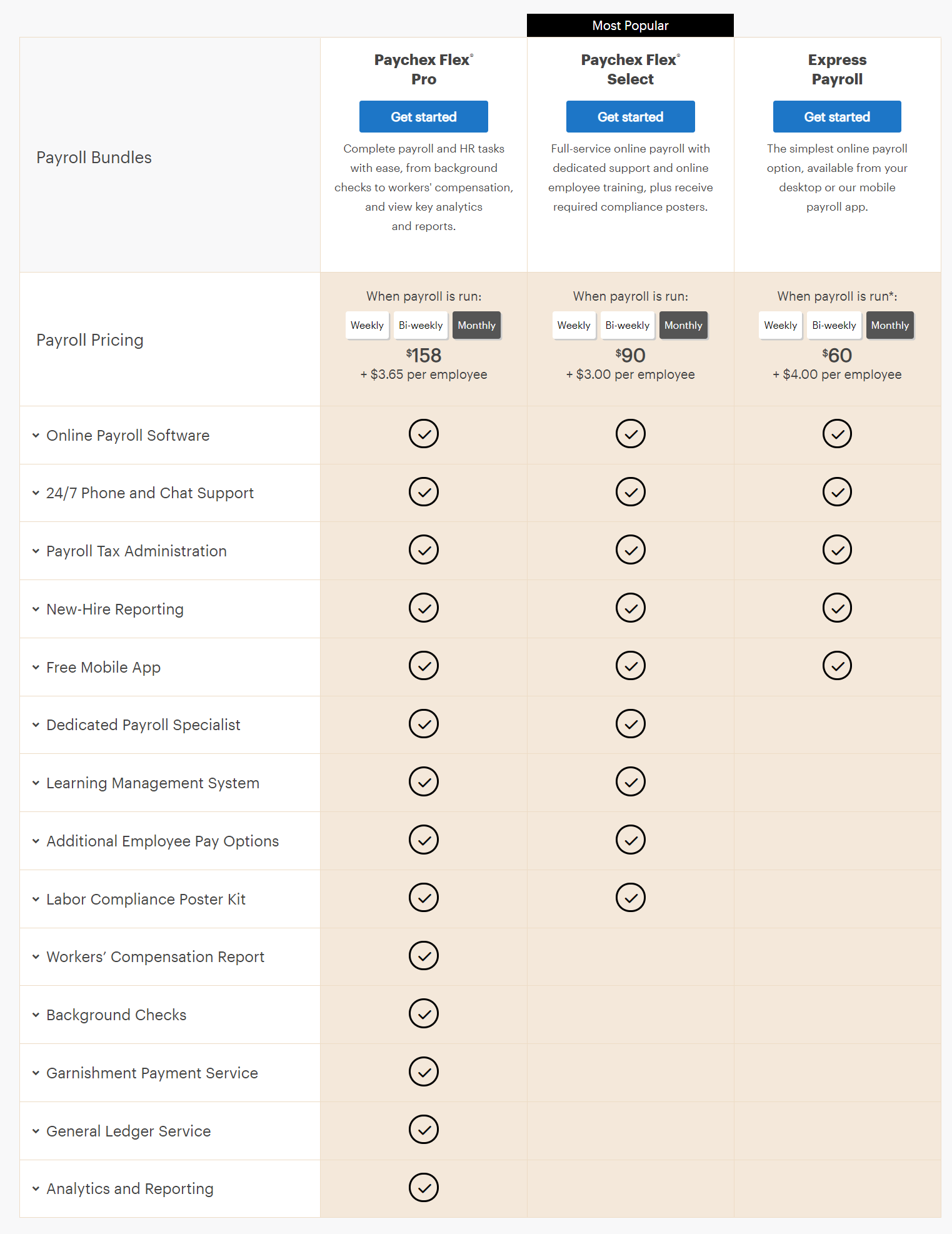

Another table suggests the fresh annual income tax professionals under the other parts of the income Tax Operate, away from 1961, reflecting the house loan attention income tax deduction and you can houses financing appeal exemption.

This loan have to be sanctioned (delivery 01.4.2016 and you may conclude 30.step 3.2017). The borrowed funds count was below or equivalent to ?35 lakh therefore the worth of assets does not meet or exceed Rs. ?fifty lakh.

Area 80C: Income tax Gurus into Fees of the house Mortgage Prominent Matter

A home loan debtor is actually allowed to allege tax advantages upwards so you’re able to ?1,50,000 toward principal payment out of his/their unique nonexempt earnings, from year to year. It work with are going to be claimed both for rental and you may worry about-filled properties.

- To claim work with significantly less than which section, the home where the mortgage might have been borrowed will be fully founded.

- Most taxation benefit of ?1,50,000 is also reported around this part for stamp responsibility and you can subscription costs; but not, it may be stated only once, we.age., during the time of such costs incurred.

- A beneficial deduction allege cannot be generated if the exact same house is offered within five years from palms.

- In such a case, any advertised deduction should be corrected around out-of income. On the other hand, that it contribution could well be included in the person’s money on the 12 months, where home is offered.

Not as much as Part 24(b), an effective taxpayer is also allege an effective deduction on notice paid off into the house loan. In this instance,

- One can possibly claim a good deduction to the notice repaid on family mortgage to own a personal-filled household. The most tax deduction anticipate is perfectly up to doing ?dos,00,000 regarding gross yearly income.

- However if a person has a couple of homes, next if that’s the case, brand new shared tax allege deduction getting mortgage brokers you should never exceed ?dos,00,000 inside the a monetary year.

- In case your domestic has been leased away, then there is zero maximum about how exactly much one can possibly claim into the appeal paid. This consists of the whole amount of appeal paid off for the domestic financing with the get, construction/repair, and you will revival or resolve.

- In the eventuality of loss, one can possibly claim good deduction from simply ?dos,00,000 for the a financial seasons, because the remaining allege are going to be sent send for a period from eight years.

Not as much as Part 24(b), a person can in addition to allege a great deduction on interest rate if your possessions bought is actually less than build, given that design is done. It section of the Act allows states on the each other pre-framework and you may post-build several months interest.

Section 80EE: More Deductions into the Attention

- That it deduction are said only if the price of the fresh domestic obtained does not surpass ?fifty lakh and the amount borrowed is perfectly up to ?35 lacs.

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!