How can Domestic Equity Loan Cost for the Maryland Work?

Household guarantee is one of the most flexible and you can valuable economic units that one can features in the the disposal. Effectively make use of it, and steer clear of they functioning up against your, a comprehensive comprehension of household guarantee will become necessary. When trying to determine what the right price is for a beneficial home collateral mortgage within the Maryland, you really must be in a position to assess the standards that go with the starting such pricing. To begin, we will explore what exactly family guarantee is so one to knowing tends to be had when deteriorating exactly how household guarantee mortgage pricing inside the Maryland functions.

What is House Guarantee?

Simply speaking, home security is the difference between the present day market price out of your house therefore the harmony remaining on the mortgage. Because of this because you help make your home loan repayments, the fresh collateral of your house develops. Domestic collateral can also increase in https://paydayloansconnecticut.com/tariffville/ case the property value your property increases. The actual property value home security arrives when it is put as the a good creditable resource that can allow you to safer good one-go out loan. Instead, you should use your house collateral as a line of credit, entitled a good HELOC.

Just how Family Collateral Money Work

House collateral money works by using the guarantee on the house while the security towards financing. Such funds are given in a single lump sum and are generally reduced into fixed payments. The eye cost are usually much lower than simply that of antique funds such handmade cards. When you’re property security loan in Maryland can be a very useful function, it is reasonably a threat which will place the possession off your property in jeopardy in the event that you default on the loan payments. Youre as well as susceptible to getting the worth of your own family drop-off which means that you’ll owe more the fresh new appraised value of your property.

Just how Home Equity Lines of credit (HELOC) Really works

A home collateral personal line of credit otherwise HELOC operates since the a personal line of credit you to enables you to borrow money, for example a credit card, which have a changeable rate of interest. HELOCs change from regular household collateral funds due to their fluctuating monthly obligations as well as the capacity to take-out very little or to you need. The newest maximum of borrowing from the bank is dependant on the amount that security of your home is really worth. HELOCs try prominent in the event you need a credit line offered as opposed to just one loan.

Requested Prices

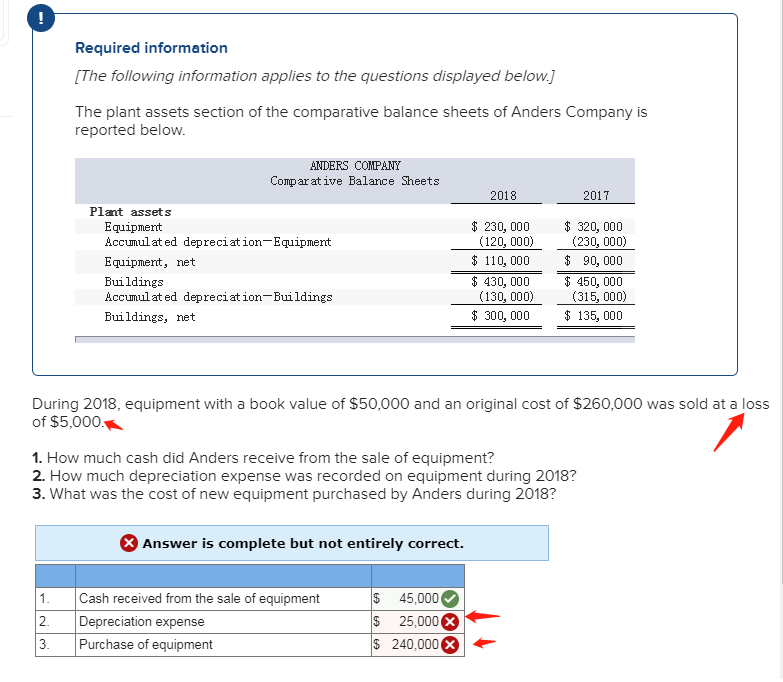

Definitely, this type of fund have standards of these seeking take-out an excellent household guarantee mortgage inside the Maryland. Most lenders wanted a credit score to be 630 or more however, so you can qualify for the best prices, a credit history more 700 is recommended. Additionally you need a loans-to-earnings proportion out-of only about 43% and you may a beneficial verifiable income source. Plus, the fresh new equity of your property should be higher than 20% of house’s overall worthy of. The present day average speed having a good HELOC home equity mortgage for the is six.51% having a variety of 5.27% 9.14% therefore the average price having a property equity financing try 7.01% having a variety of six.45% -8.16%.

Federal Hills’ Home Security Expert Service

Home guarantee is one of the most enticing regions of domestic control, exactly what happens when youre stopped away from accessing your residence equity on account of a compulsory re-finance? Federal Hill Mortgage keeps an answer with our Household Collateral Specialist Services. Now, you need to use access your own equity without having to refinance or replace your current mortgage price. At exactly the same time, you can get to love zero aside-of-pocket closing costs and no traditional assessment needs in most instances. We to allow one to use your house security and you will leverage your house investment that have Federal Slope Mortgages Household Guarantee Pro Service.

Have the best House Guarantee Loan Prices into the Maryland

If you’re looking to possess a lending company and you may broker in order to help you support the reduced family security loan rates within the Maryland, your pursuit comes to an end having Government Slope Financial. Our very own positives often skillfully show you through the family guarantee process and ensure that you will get the most from your residence. Incorporate today to find out how we are able to help your house be collateral help you!

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!