Normally FHA Home loan Insurance coverage Go off at 20% Domestic Guarantee Top?

If you are considering playing with an FHA loan to find a house, you could have read that they require mortgage insurance coverage. You might end up being questioning when the FHA home loan insurance coverage would be got rid of once you have hit 20% security in your home, as with a normal (or non-government-backed) financial.

The latest brief response is, it all depends. If one makes a deposit away from step three.5%, like most borrowers which use FHA finance, that you will find to expend yearly home loan insurance rates into life of the mortgage. In this situation, your FHA financial insurance policies can not be eliminated, even although you started to 20% guarantee.

Yet not, if one makes a down payment out-of ten% or even more while using the an enthusiastic FHA mortgage, the new yearly financial insurance policies would be canceled immediately following eleven age.

Note: The aforementioned legislation apply at FHA buy funds in particular (we.elizabeth., those people employed by home buyers). The newest Improve Refinance program has its own selection of guidelines, to get secure in a new post.

Two types of FHA Mortgage Insurance policies

FHA mortgage brokers was insured by the national, in management of this new Company of Construction and you will Urban Innovation (HUD). It is therefore the federal government you to definitely decides the assistance and requires for this system.

Certainly one of their needs is that borrowers exactly who have fun with an enthusiastic FHA loan need to pay getting mortgage insurance rates. In fact, there are two other premiums consumers need to pay.

- cash advance america Victor

- Brand new Upfront Mortgage Insurance premium (UFMIP) means step one.75% of ft loan amount. This might be a single-go out payment you to definitely, even with their name, would be rolling into mortgage money and paid back over the years.

- The fresh new Annual Mortgage Cost (MIP) can differ based on the regards to the loan. For many consumers whom play with an FHA financing having a great step three.5% down payment, the fresh new yearly mortgage premium relates to 0.85%.

And this is where things score some time complicated. Particular consumers can terminate its annual FHA home loan insurance policies just after 11 decades, while some try stuck with it into the lifetime of the loan. The difference is because of how much cash your set out.

Which have a downpayment out-of ten% or even more, the mortgage-to-really worth (LTV) ratio is equal to otherwise less than 90%. In this situation, individuals which have an FHA financing could have their annual home loan insurance rates canceled once 11 years.

With a down-payment below 5%, the loan-to-really worth ratio ends up becoming higher than 95%. In this case, HUD needs individuals to blow FHA yearly financial insurance into the longevity of the loan.

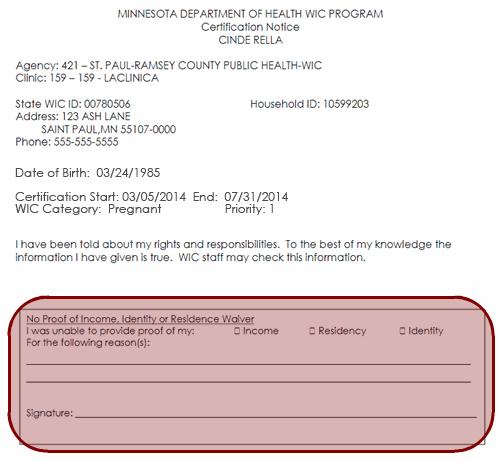

The fresh dining table less than was copied away from HUD Manual 4000.1, the state recommendations into the FHA loan system. The latest desk suggests this new yearly MIP cancellation options (or use up all your thereof), in line with the certain mortgage variables.

Its really worth noting yet that the majority of home people just who fool around with a keen FHA loan build a deposit below 5%. Actually, this is what pulls these to the application form in the 1st set.

The brand new FHA home loan program lets consumers to make a downpayment as low as 3.5%. Thus, this method lures homebuyers with minimal loans protected upwards on very first initial funding.

Therefore, most FHA individuals make a deposit below 5%, which means he’s got a primary LTV ratio more than 95%. Perhaps you have realized about dining table over, it means they might have to pay FHA yearly home loan insurance policies on longevity of the borrowed funds (or even the home loan label for the industry slang).

Will it be Canceled or Removed from the 20% Guarantee?

You might’ve heard that some people who’ve home loan insurance rates normally get it canceled when they visited 20% equity otherwise possession in their home. This really is genuine, however it mainly applies to conventional mortgage loans.

The word conventional makes reference to home financing that is not recognized otherwise guaranteed of the federal government. Quite simply, conventional and you may FHA mortgages are a couple of different things entirely.

While using the a normal home loan, that have a keen LTV proportion higher than 80% normally demands personal mortgage insurance rates. But this is totally different from government entities-requisite home loan insurance policies one to relates to FHA fund.

As well, residents which have a traditional mortgage can usually has its PMI policy canceled once they visited 20% collateral in their home. Stated in another way: Capable terminate its mortgage insurance policies when the mortgage-to-value ratio drops in order to 80% or less than.

You have the right to demand that servicer terminate PMI if you have achieved this new day in the event that prominent equilibrium out-of their home loan is set to fall to help you 80 % of the new property value your property.

However, so it 20% rule constantly does not apply to FHA funds. Even if you can terminate this new yearly mortgage insurance rates to the an enthusiastic FHA mortgage features far more related to the size of the down-payment, rather than the security peak you have of your home.

Obviously, you can re-finance away from an enthusiastic FHA mortgage and you can to your a traditional mortgage at a later date. Very that is a different way to get away from this new FHA annual MIP bills. Just remember one to antique loans also can want financial insurance coverage, particularly if the mortgage-to-well worth ratio increases significantly more than 80%.

Report about Tips

We covered plenty of guidance on this page. Thus let us wrap-up with a list of the main takeaway facts you really need to consider:

- Question: Can also be FHA mortgage insurance coverage go off in the 20% equity?

- There’s two types of financial insurance coverage assigned to FHA loans – initial and you will yearly.

- The new initial premium (UFMIP) constantly wide variety to 1.75% of one’s base amount borrowed.

- The latest annual advanced (MIP) for the majority of consumers whom have fun with FHA financing concerns 0.85%.

- However the annual MIP can differ, in accordance with the down-payment matter and the financing title or duration.

- Individuals just who set out ten% or higher can usually features the FHA MIP terminated after 11 many years.

- Consumers whom build a smaller sized down payment (lower than 5%) typically have to invest FHA annual financial insurance coverage into the life of one’s loan.

Disclaimer: This particular article brings an elementary overview of FHA mortgage insurance termination rules, predicated on official advice provided with brand new Agency off Casing and you will Urban Innovation. Financial financing situations may vary from one borrower to a higher. This means that, portions in the post may well not apply to your role. If you have concerns or issues about the niche, we prompt one contact the FHA otherwise consult with good HUD-accepted home loan company. You’ll be able to refer to HUD Guide 4000.1, which is available on the web.

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!