step one. Decide which mortgage is perfect for your

Begin by deciding on your options for property security financing. Could you rating a cost that works for you into the good timeframe that’s suitable for assembling your shed?

A house collateral loan will likely take more time – oftentimes, longer – than property update mortgage. Your home improvement loan possess a high interest rate but it’s possible to obtain the cash in a question of months, not months otherwise months.

2. Look at the credit rating

Your credit rating is based on multiple points, including the period of your credit report, how good you have carried out with while making money timely, along with your debt to income proportion.

The better your credit rating, the new a reduced amount of a danger the financial institution is of course into the giving you a loan. A top score entails you could discover far lower focus pricing and better conditions.

Understand that your credit report cannot always promote you a credit history. You should know the real difference.

step 3. Come across an informed cost

Do it yourself loan cost derive from this new annual percentage rate and will are normally taken for 1%-2% to help you up to 30% or more.

Your price could be customized, considering your own creditworthiness or any other points, however it is a good idea to glance at the possible range before applying. The following is a https://paydayloancolorado.net/sawpit/ long list of pricing private loans.

cuatro. Score prepared and implement

You will want a multitude of monetary data, instance lender comments and you can taxation statements. You also have proof income, and proof of what you decide to would having the loan. Collect all the data you may want before you start the brand new software process to allow all smoother ultimately.

5. Don’t start solutions otherwise home improvements until the loan are funded

Often you can buy a beneficial preapproval for a loan, and therefore implies that the lender are likely to provide it with for you, but they need to feedback so much more data files and determine toward simply just how much regarding financing you can buy.

Wait until the loan is not just approved, nevertheless have the money at hand prior to beginning people brand of home improvements.

6. Pay-off your loan

Particular lenders offer a sophistication age a couple months ahead of money start working. Immediately following it is time to generate payments, be sure to make sure they are completely, punctually, everytime. This will help establish a robust credit rating, so that the 2nd financing you earn will get finest terms than just this. If you pay it back early? You to definitely depends on whether there clearly was a prepayment penalty. Occasionally, you to definitely penalty will in reality be more than the accrued appeal; in this case, it’s better to only create men and women monthly obligations.

How AmONE May help Fix or Renovate your property

We could carry out the legwork for you with these 100 % free services to help you get the best personal loans for the state.

Have you made use of handmade cards to resolve enhance family and today you are interested in debt consolidation? Our system fits your to the better debt consolidation functions to have you.

Talk about our wide variety of options available to you personally, or contact our mortgage pros locate methods to your concerns. Sign up our of several satisfied website subscribers that have removed fees of the financial lifetime and you will satisfied their cash requires.

Do-it-yourself Fund Advantages and disadvantages

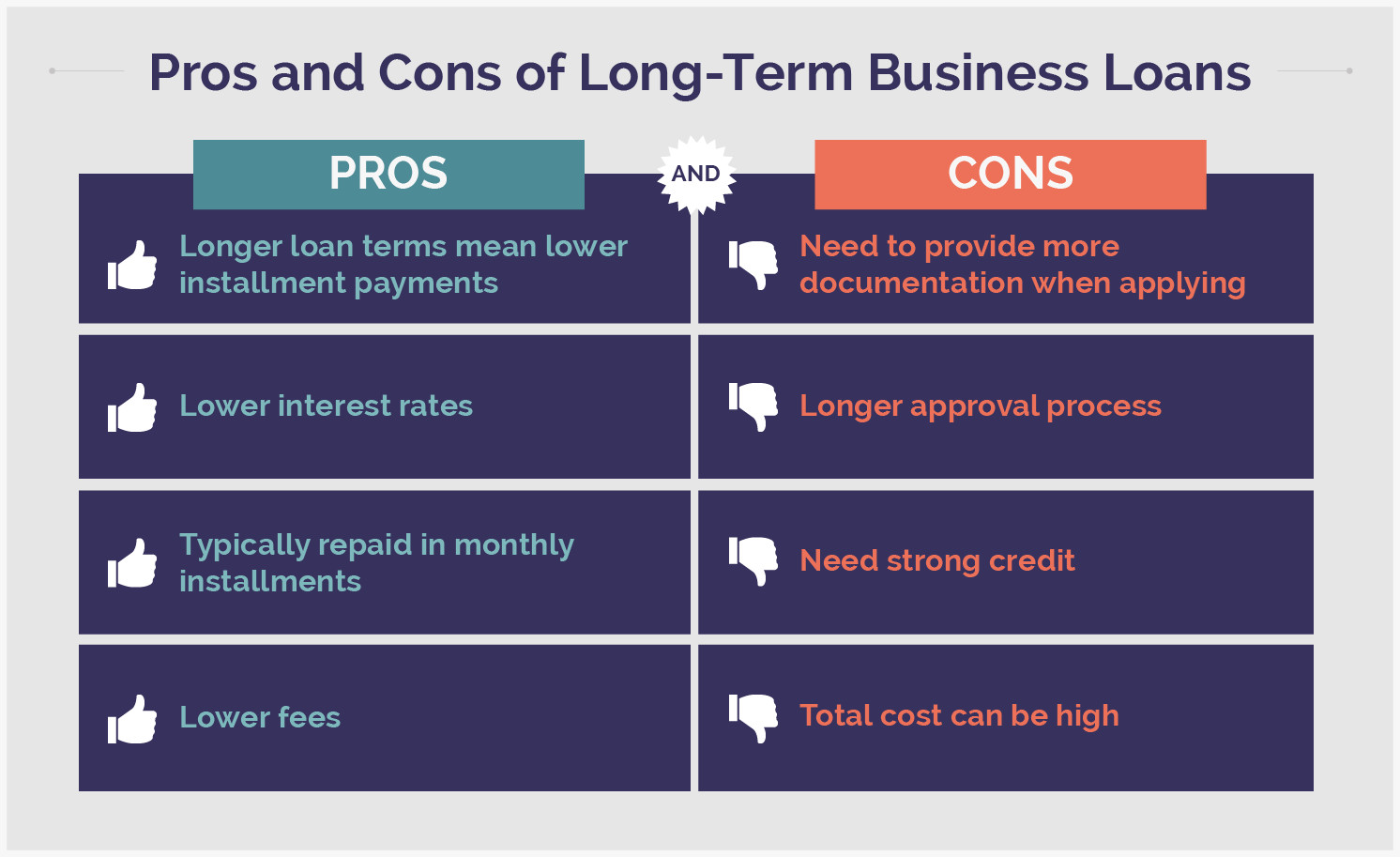

Just like any other kind away from loan, there are pros and cons. The theory is that the gurus will always provide more benefits than the drawbacks and work out the mortgage a more reasonable selection. This is what we provide from home improvement financing.

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!