Taking a house Equity Financing against another Financial from inside the Ontario

Purchasing your very first residence is probably one of the most very important financial investments you might make. Like any nice financial support, there are a number of experts you accrue.

Aside from the balances and you will morale provided when you are a homeowner, getting your property plus allows you to generate collateral throughout the years. You can utilize it guarantee while the equity to shop for another possessions if you don’t borrow on they in the future.

So why do anybody take-out second mortgage loans?

Homeowners borrow on their house guarantee a variety of grounds. A few of the most common causes are needing to borrow cash to pay for big home renovations or costs such as for instance school, getaways or wedding parties.

If you are a traditional mortgage requires a hefty deposit to behave because the security, which have one minute financial, you’re utilizing your household due to the fact guarantee.

The most popular ways credit up against your property security are by way of a house equity loan otherwise second home loan otherwise of the starting a home equity personal line of credit.

Preferred Methods of Accessing Home Equity

A home security mortgage is different from a classic mortgage. As previously mentioned, when potential people get their 1st home loan, they’re going to must give collateral to your financial or lenders.

However, whenever making an application for a house security loan, they normally use the new equity they will have built in their home to own equity. While this shall be referred to as often a house guarantee financing or a second mortgage, it effortlessly suggest the same: financing could have been applied for against the house’s equity.

While you are a property equity mortgage another home loan relate to the exact same thing, there is an alternative choice are not noticed by homeowners seeking supply home security: a property security line of credit.

Discover pros and cons so you can both methods, and also to choose which one to pursue, you’ll want to examine individual condition and view that renders by far the most feel to you personally.

Household Equity Loan/Next Home loan

A house equity financing is actually a lump sum payment loan that utilizes your property just like the collateral. The loan matter lies in new equity you really have in the your house, which is the difference in the appraised worth of your residence while the an excellent balance of your own mortgage.

House guarantee financing routinely have a fixed rate of interest, which means costs sit a similar on life of the mortgage.

- Family equity funds should be better to be eligible for than many other style of funds because your house is put once the guarantee.

- The interest rate to the a house collateral loan is oftentimes repaired, so you know exactly exactly how much you will need to shell out every month.

- Household equity loans could possibly offer straight down interest rates than other products regarding finance, particularly signature loans otherwise playing cards.

- House equity financing was shielded by the home, when you standard into loan, you could potentially cure your property.

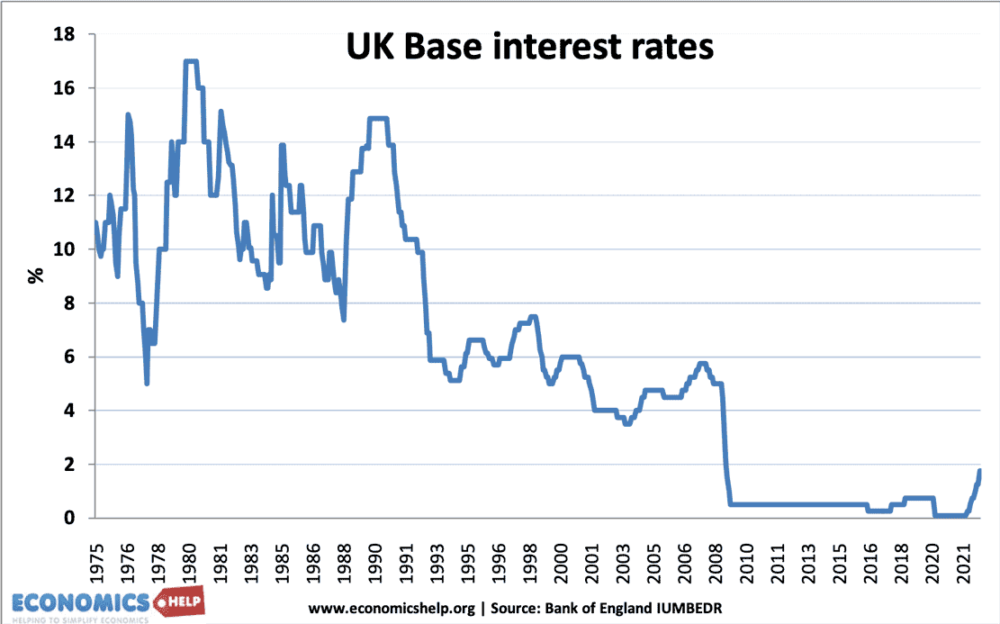

- The speed towards property collateral mortgage can be higher compared to the interest on your financial, according to the field criteria at the time you take aside the loan.

Family Guarantee Line of credit (HELOC)

A great HELOC was a beneficial revolving personal line of credit that utilizes your household since the equity. You might acquire to a certain limitation making money as you go, like a credit card. The rate on the a beneficial HELOC often is changeable, which means that it can increase otherwise down through the years.

- HELOCs could possibly offer a lower rate of interest than many other type of finance, such as for instance credit cards.

- You merely make repayments to your amount of money you obtain, that it is simpler to plan for their monthly obligations.

- The rate into the a great HELOC are adjustable, which means that it will go up or off through the years. This makes it hard to cover the monthly installments.

- Particularly another mortgage, HELOCs try protected by your house, that can throws your residence at risk if you cannot create payments.

Evaluating HELOCs and you will Household Equity Funds

There are key differences between household equity fund and you will second mortgages. Here are about three to help you evaluate each other:

What to Think When choosing Anywhere between a house Security Financing and you may good HELOC

The sort of loan that’s right to you all depends for the a great amount of activities, including your finances, their arrangements for cash, as well as how far security you’ve got of your property.

If you would like an enormous sum of profit all at once and you have good credit, property equity financing will be the best option. The pace towards the property security mortgage is often down than just that of an unsecured loan or any other kind of unsecured loan.

not, if you’d like far more independency in order to make monthly payments otherwise only need to acquire some currency, a great HELOC is the best choice. Using this means, you pay attention towards the money that you lent, making it easier to deal with the monthly payments.

No matter which variety of loan you select, you should browse the and you can check around and you may contrast notice rates before borrowing from the bank.

The significance of Finding the right Financial

Whether you are trying receive family security otherwise an additional financial, selecting the most appropriate lender is essential to getting an informed offer you can.

At Canadalend, we have been serious about assisting you to get the best you’ll be able to loan for your requirements. I have a small grouping of experienced home loans who can functions to you to find the right mortgage and have the greatest rates possible. More resources for house guarantee financing and you may second mortgage loans, name our specialists on Canadalend now on 1-844-586-0713 or call us on the internet now!

More about the author.

As Co-Founder and President, Bob Aggarwal might have been important in making an inclusive and you will consumer-centric business people in the Canadalend. These types of regulations and procedures features skyrocketed the organization into becoming you to of the biggest volume Home loan Brokerages for the Ontario once the the inception in 2005. Doing his community because the a brokerage dedicated to short in order to medium organizations he has because expanded to add new home-based, commercial, and paydayloansconnecticut.com/lakes-east you may consumer markets. He will continue to guide Canadalend up to now and have spending some time together with family you should definitely closure revenue.

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!