The Best Way To pocket option course

XTB

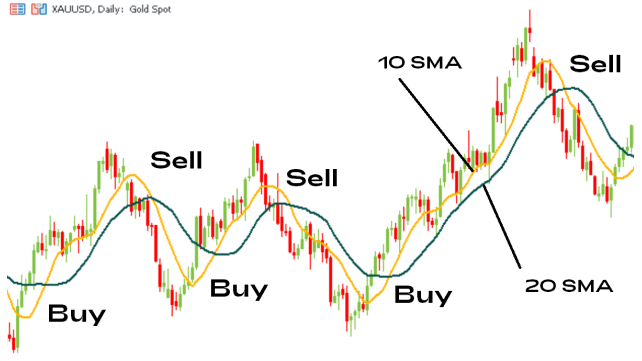

No trading indicator can give you a definite answer as to what the market is going to do next. And if they are not adept at managing short term risk, their losses can mount quickly after the double bottom fails. If market prices become unfavorable for option holders, they will let the option expire worthless and not exercise this right, ensuring that potential losses are not higher than the premium. The securities quoted are for illustration only and are not recommendatory. Mon to Fri: 8 AM to 5:30 PM. I signed up to use this app and went though all my verifications which took some time as expected. In this case the line of resistance is steeper than the support. Also, most US market reports are released early in the New York session, creating market volatility and scalping opportunities. We think there’s no better place to start than with Stock Advisor, the flagship stock picking service of our company, The Motley Fool. It’s essential to double check the details to avoid costly mistakes when you’re trading. Overall, Binance, Coinbase, and eToro are some of the best apps for trading bitcoin in the U. Multiple chart scalping is one technical indicator that’s appropriate for a scalping trading strategy. Remember that the trading limit for each lot includes margin money used for leverage. 12 April 2024 18min Read. In case the brochure was not auto downloaded, click here. If your prediction is correct, you’ll make a profit. If your balance does go negative, we’ll bring it back up to zero at no cost to you. Options trading typically includes commissions charged by the broker, as well as exchange and regulatory fees. However, intraday trading may be dangerous and should only be used when you have a solid grasp of the particular stock or industry. IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. Test new strategies without putting your capital at risk. Initial profit targets are set at the height of the previous move. I am an Assistant Professor at International School of Management Excellence ISME, a leading private b schools in Bengaluru. Trading bitcoin on an exchange. Not all investors will be eligible to trade on Margin. In essence, good risk management can help you minimise your losses while maximising your gains. Stocks often tend to retrace a certain percentage within a trend before reversing again, and plotting horizontal lines at the classic Fibonacci ratios of 23. Scan the QR code or install from the link. Many times it might just take one more condition to filter out a lot of bad trades and really improve on the strategy.

Embarking on Investment Education

F Depreciation and amortization expenses. But what if your short term goal was to trade on the smallest «transaction» level. Having traded with IG for many years, I found the IG Web Trader platform easy to use but feature rich with fully customizable layouts. They trade multiple times a day to earn small portions of profits. Use this KuCoin referral code 2Nh1HJ3 link and get up to 700 USDT in rewards. One of our training experts will be in touch shortly to go over your training requirements. Finally, keep in mind that if you trade on margin, you can be far more vulnerable to sudden price movements. Third, you will have access to the latest analysis. Set price alerts, stop losses, take profits and trailing. Scalping is a trading strategy that requires the trader to place multiple trades, which seek to close out small profits over extremely short time frames. Investment in the securities involves risks, investor should consult his own advisors/consultant to determine the merits and risks of investment. CFDs can be opened on margin. It’s immensely difficult to do successfully because a trader must compete with market makers for the shares on both bids and offers. App Store is a service mark of Apple Inc. Trade Nation is a trading name of Trade Nation Financial Pty Ltd, a financial services company registered in South Africa under number 2018 / 418755 / 07, is authorised and regulated by the Financial Sector Conduct Authority FSCA, with licence number 49846. Pair with Fibonacci Retracement Levels: Use Fibonacci retracement levels to identify potential support and resistance levels that match the patterns on your cheat sheet. When you sell an option, you have an obligation to fulfill the contract. IIFL Securities offers a reliable trading platform with flat brokerage fees and good research support, making it a solid choice for traders who appreciate consistent costs and strong market insights. A Red Ventures company. Accurate calculation of gross profit or gross https://pocketoption-ru.online/viewtopic.php?t=120&sid=d6d5099fb62420276f6494bebb781d84 loss, unable businesses to understand their financial performance in a better way. Intraday trading hinges on the concept of «buy low, sell high» or, conversely, «short sell high, buy low. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. Captivated by the app’s user friendly interface and the promise of doubling his money by completing daily tasks, Saikia decided to download it. Sudden news or market events can break the price ranges, leading to abrupt or unfavorable price movements. It does not constitute legal, financial, or professional advice. The name «Wall Street» comes from a street in downtown Manhattan in New York City where the New York Stock Exchange NYSE is located.

24/7

This enables them to trade more shares and contribute more liquidity with a set amount of capital, while limiting the risk that they will not be able to exit a position in the stock. Prices breaking out of the narrow range in the opposite direction of the prior trend indicates the completion of these patterns. We’ve broken down these good business ideas into a few different sections. You can allocate a portion of your portfolio towards swing trading to generate supplemental income to help with bills or enhance your lifestyle. Sometimes they can seem a bit 50/50 in nature. Mazagon Dock Share Price. Individual traders don’t necessarily have 100,000 dollars, pounds or euros to place on every trade, so many forex trading providers like tastyfx offer leveraged products that allow traders to open a full lot of EUR/USD for only euro sign 2000 of initial margin. What is Trade and Carry.

Q5 What documents are required to open a zero brokerage account with StoxBox?

Definition: Implied volatility is the market’s forecast of a likely movement in a security’s price. Was this page helpful. Among the most notable indicators, VWAP calculates the overall average of an asset within a specific time frame. This is why options are considered to be a security most suitable for experienced professional investors. If you are either long or short and an opposite signal happens, close the current trade and enter the opposite direction. Muhurat Trading will be conducted on Friday, November 01, 2024. There are two key variables to consider when choosing the stocks to swing trade: liquidity and volatility. Swing trading is an excellent method for profiting from the market’s short term volatility. Technical analysis acts as a compass for swing traders navigating the market. By contrast, if the total amount of gross profit and other operating incomes is less than the operating expenses, then the difference is treated as a net loss. According to a study https://pocketoption-ru.online/ published in the «Journal of Behavioral Finance» by Dr. Read our warranty and liability disclaimer for more info. Separating homework from the act of trading is important. Free online Forex trading classes can offer tremendous value to beginners. The next step that lies ahead is adding funds to your demat and trading a/c. Investment Advisers Act of 1940, as amended the «Advisers Act» and together with the 1934 Act, the «Acts, and under applicable state laws in the United States. Researching the many factors that can affect an option’s value adds extra layers of complexity when compared to trading individual stocks and ETFs. At the same time, it also allows speculators to profit from commodities that are expected to spike in the future. Before you dive into any specific type of trading, it’s crucial to grasp the fundamentals of trading. Also, make sure to have the latest version of the app and if after all of this you still experience issues, please contact our customer service team and always check the desktop version as well. Successful day trading relies very much on discipline and emotional control. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. Advertiser Disclosure: StockBrokers. If you want to know more about tick charts and how I trade them on the Futures market, check out my Youtube playlist. Blain created the original scoring rubric for StockBrokers.

Issue loading the information

We offer over 80 international indices, so you can trade any of the world’s the biggest and most popular indices with us. Sophisticated algorithms are used to lower the cost of every trade – after all, even a successful plan can be brought down if each position costs too much to open and close. This plan should be tailored to your specific circumstances and must be adapted to factor in your risk tolerance and buying power. If you’re on the fence, I encourage you to jump right over and take it for a spin with their risk free trial. A financial advisor told me about TruWealth once but they had a minimum investment that I could not match. One downside: Robinhood offers only individual taxable accounts and traditional and Roth IRAs. Passive traders buy based on overall market trends, and sell when they believe the security hits its peak, which can take months. Day trading involves actively buying and selling securities within the same day, trying to capitalize on short term changes in price. International investment is not supervised by any regulatory body in India. Scalping works when markets are moving up and down. This involves buying and selling stocks within the same day. Other traders might instead want to pay closer attention to the performance metrics of the backtest.

Brokerage

Define your trading strategy, including the types of options strategies you plan to execute, your entry and exit criteria, and how you’ll manage risk. That’s easier to handle when you love what you do. OnRobinhood’sSecure Website. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Gain insights into range trading strategies and techniques for consistent profits. Scalpers rely on technical analysis tools and charts to identify potential entry and exit points. Get to know the specific timings for various commodity exchanges in India, such as MCX and NCDEX. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority. » TradingView has over 50 million users. Securities and Exchange Commission SEC prohibited fixed commission rates, and commission rates dropped significantly. When trading in financial markets, you will encounter several popular trading strategies. CHUNYIP WONG / Getty Images. The value of candlesticks, which have been around for centuries, is in the story they tell. American options can be exercised at any time between the date of purchase and the expiration date.

10 Best Cheap Stocks Of September 2024

Head and shoulders is a reversal pattern that can appear at market tops or bottoms as a series of three pushes: an initial peak or trough, followed by a second and larger one, and then a third push that mimics the first. This email message does not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services and/or shall not be considered as an advertisement tool. Here’s how I go about it. Yes, intraday trading typically involves higher leverage and lower margin requirements compared to delivery trading, where the full price of the shares is required unless margin financing is used. These investors tend to buy and sell assets frequently, often within the same trading session, and their accounts are subject to special regulation as a result. You get RCMC by submitting your IEC number and paying the necessary fees. If your prediction is correct, you’ll make a profit. The best way to learn to read candlestick patterns is to practice entering and exiting trades from the signals they give. Today «trading company» mainly refers to global B2B traders, highly specialized in one goods category and with a strong logistic organization. Open Account Instantly. Download the intraday trading app to start trading. Because this deposit gives you an exposure 10 times its size, the leverage ratio is 10:1. This course is designed for those who want to learn options professionally. Plus500AU Pty Ltd holds AFSL 417727 issued by ASIC, FSP No. Decimalization changed the minimum tick size from 1/16 of a dollar US$0. Develop and improve services. Merrill Edge charges no fees for stock and ETF trades, while options trades come in at $0. You could also place orders aftermarket and even during market hours. Apple IOS and Android.

NSE Group Companies

So just because it’s free doesn’t mean it’s better. The broker will lend you additional funds, thereby increasing your profit potential. 9, Raheja Mindspace, Airoli Knowledge Park Rd, MSEB Staff Colony, TTC Industrial Area, Airoli, Navi Mumbai, Maharashtra 400708, India. To see if this is the case, we will compare the fees of the different brokers. Trendlines will vary depending on what part of the price bar is used to «connect the dots. Features such as Advanced Charts, Watchlists, FandO Insights @ Fingertips, Payoff Analyzer, Basket Order, Cloud Order, Option Express, e ATM, Systematic Equity Plan SEP, i Track, i Lens, Price Improvement Order, Flash Trade, Strategy Builder etc. There are several technical problems with short sales: the broker may not have shares to lend in a specific issue, the broker can call for the return of its shares at any time, and some restrictions are imposed in America by the U. According to the Securities and Exchange Commission SEC, margin trading increases the potential for higher gains and also higher losses than investing solely with cash. City Index mobile, MetaTrader mobile. This book is a must for any serious trader’s library. The research paper «Global Political Risk and Currency Momentum» by Ilias Filippou, Arie Eskenazi Gozluklu, and Mark P. A defined risk reward ratio helps implement sound money management. You could harness paper trading for a few months, for example, before switching to executing trades with actual money. Investopedia does not provide tax, investment, or financial services and advice. Some of them may offer light financial planning, or low cost or transparent investment options. Sometimes called IBKR for short, Interactive Brokers offers multiple types of accounts, including ones that work well for retail investors and professional and institutional investors. A long straddle can only lose a maximum of what you paid for it. Like its bullish counterpart, the inverted hammer pattern has a small body. Once the stock made a golden cross, it really never looked back before launching yet again in June of 2021. This strategy is useful for traders who take a more patient approach and seek to benefit from the overarching market trends. It is a powerful tool that can help multiply your investment potential and returns. You have access to more than 1000 trading assets. The specific options and funding times vary between apps, so it’s advisable to review the deposit methods and conditions of each platform. A margin call is when the total funds you’ve deposited onto your account, plus or minus any profits or losses, drops below your margin requirement. When trading forex, you’ll be speculating on whether one currency’s price will rise or fall against another currency – for example, if the US dollar USD will weaken or strengthen against the Euro EUR. View more search results. 70% of retail client accounts lose money when trading CFDs, with this investment provider. This fosters continuous learning and adapting to ever changing market conditions.