The real difference with a face-to-face Financial and you will an effective HEA

The Government Construction Power brings very opposite mortgage loans as a result of accepted loan providers. To help you qualify for a contrary financial, you must be about 62 years old and get good guarantee in your home (usually no less than 50%).

The reverse home loan is actually payable through to the new borrower’s death, when the borrower motions from their house or in the event the debtor deal our home.

Our home security contract has no ages requirement. It provides cash in advance in return for a fraction of your own residence’s upcoming worth. How much you can found depends on the amount of equity you really have established in your home.

Finding fund: How it works

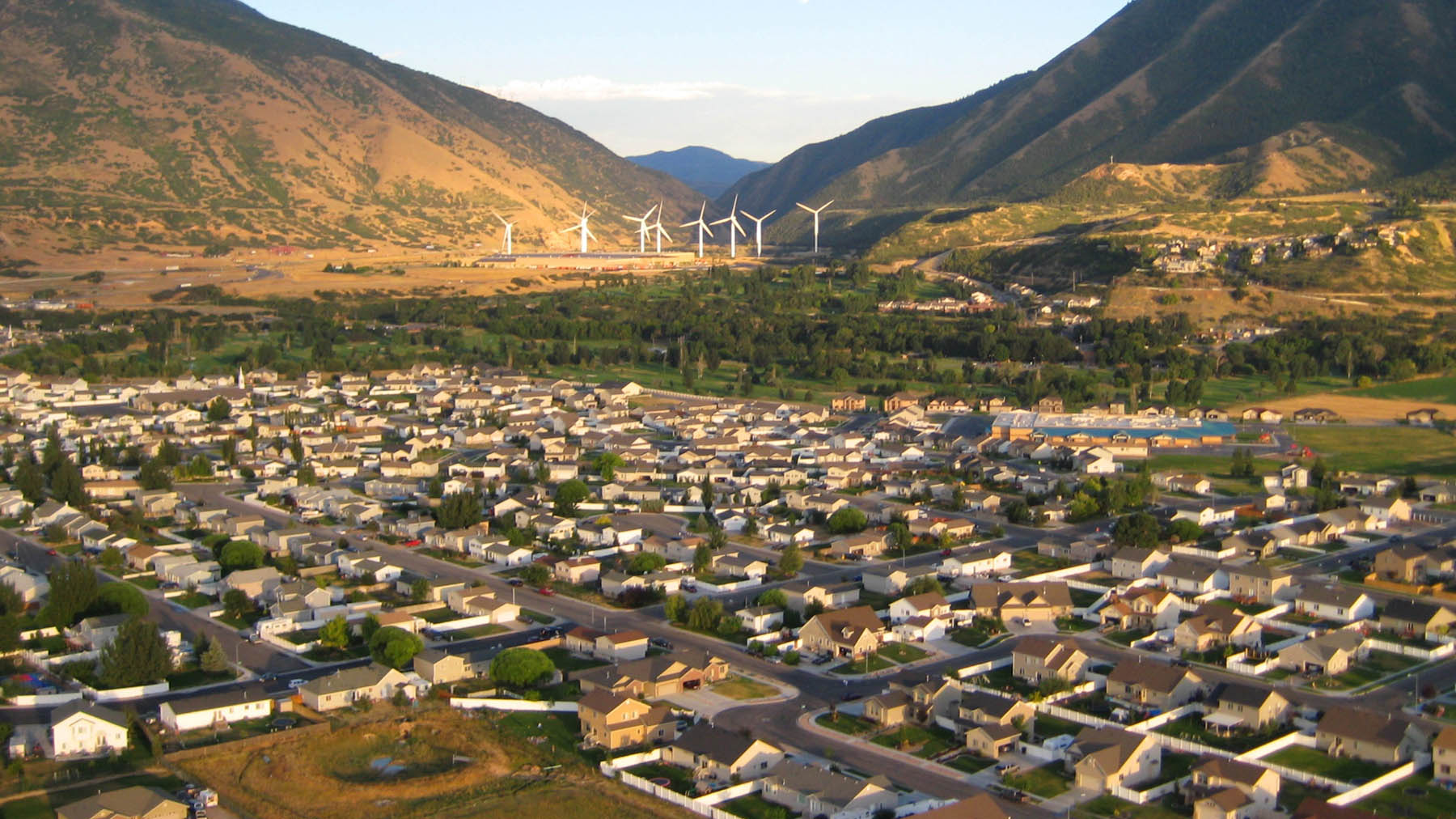

For those who very own property, you’re sure residing their prominent house. If you want money, you might be able to put you to resource to use owing to a face-to-face mortgage or domestic guarantee arrangement (HEA).

Both allow it to https://paydayloansconnecticut.com/storrs/ be homeowners so you’re able to tap into the home’s guarantee. But not, the opposite financial is actually prepared totally differently regarding an excellent HEA. The former feels like that loan with interest, once the latter isnt financing, and will be offering cash in advance in return for a portion of your house’s coming worthy of.

To decide whether an opposing financial or household collateral arrangement try ideal to suit your finances, you could potentially imagine what kind of cash need, how old you are, lifetime span plus residence’s most recent worth.

The opposite home loan

The reverse home loan is unique one of house guarantee resource options. In lieu of generate payments to a lender as you manage to own a typical home loan, a reverse home loan is really what it sounds for example: the lending company will pay you alternatively. Reverse mortgage loans is managed because of the Federal Housing Power (FHA) and you will provided by accepted loan providers.

An opposite mortgage spends your residence guarantee to settle your own existing financial (if you have you to definitely). After performing this, you are going to receive any remaining proceeds from the fresh financing (the reverse mortgage). If you already very own your property downright, you’re getting all the proceeds.

To be eligible for a contrary home loan, you need to satisfy two requirements: (1) you’re no less than 62 yrs . old and you may (2) you’ve got nice security of your house (for the majority lenders, it is at least 50%). Deduct the full a great financial matter from your own residence’s latest value to choose your residence security.

Capacity to shell out related charges: Origination percentage, simple closing costs, financing maintenance charge, attract, month-to-month financial insurance fees and additionally an initial financial insurance policies advanced

Getting contrary home loan repayments

The most used brand of contrary home loan is the house collateral transformation financial (HECM). This new HECM lets homeowners to help you acquire a maximum amount based on the:

- Youngest borrower’s ages

- Loan’s interest rate

- The brand new smaller of house’s appraised worth or the FHA’s restriction claim count ($970,800)

- Lump sum

- Annuity money (equal monthly obligations)

- Label payments (label lay of the borrower)

- Line of credit

- Annuity repayments having a personal line of credit

- Title payments and additionally a line of credit

Paying down the reverse home loan

You ought to pay back the reverse financial through to the newest thickness of particular events: in the event the borrower becomes deceased, motions outside of the home for at least 12 months (together with to possess medical reasons) otherwise sells the house otherwise does not spend possessions fees or insurance policies, or will not take care of the family.

There are not any criteria to own monthly installments just like the loan equilibrium will not come owed until one among these events occur. However, some people do build monthly obligations, since it decreases focus that accrues towards the mortgage. Unless you generate monthly payments, the lender could add interest for the overall mortgage equilibrium.

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!