Types of Old-fashioned Mortgages as well as how It works

Highlights:

- Traditional mortgages is supported by personal lenders instead of of the regulators applications such as the Federal Construction Administration.

- Old-fashioned mortgages was put into two classes: conforming loans, hence go after certain recommendations outlined from the Federal Houses Money Service, and you may non-conforming loans, which do not follow such exact same direction.

- If you are searching to qualify for a conventional mortgage, make an effort to increase your credit scores, reduce your loans-to-earnings proportion and spend less to own an advance payment.

Antique mortgage (or domestic) loans have every shapes and forms with different interest levels, terminology, requirements and you will credit rating criteria. Some tips about what to know about the types of traditional loans, as well as how to pick the loan this is the better earliest getting your financial situation.

Exactly what are conventional financing and exactly how create they work?

The term conventional financing describes people home loan that’s supported by a personal bank as an alternative out-of an authorities system like the Federal Homes Government (FHA), U.S. Department away from Agriculture (USDA) or U.S. Agencies out-of Pros Circumstances (VA). Old-fashioned loans is the popular financial available options to help you homebuyers and tend to be generally split up into a couple classes: compliant and non-conforming.

Compliant finance consider mortgage loans you to definitely meet up with the assistance set of the the new Federal Houses Loans Service (FHFA ). These tips is restrict mortgage amounts that lenders could offer, along with the lowest fico scores, down money and you may obligations-to-money (DTI) ratios that borrowers have to fulfill in order to qualify for an excellent financing. Conforming money was backed by Federal national mortgage association and Freddie Mac computer , one or two bodies-sponsored teams that work to save the brand new U.S. housing marketplace stable and you may affordable.

The latest FHFA assistance should dissuade loan providers out-of offering large financing in order to risky borrowers. Thus, bank recognition for old-fashioned finance should be difficult. However, borrowers who do be eligible for a compliant mortgage essentially make the most of straight down interest levels and you can less fees than just they will receive with almost every other financing choices.

Non-conforming fund, while doing so, cannot conform to FHFA conditions, and cannot be supported by Federal national mortgage association or Freddie Mac computer. Such loans could be larger than simply compliant financing, and could be offered to individuals having straight down credit scores and higher debt-to-income percentages. Due to the fact a swap-from because of it enhanced usage of, individuals can get deal with large interest rates or any other expenses instance individual home loan insurance coverage.

Compliant and you can non-conforming fund for each and every offer certain positive points to borrowers, and you may possibly financing variety of could be appealing according to your individual monetary products. Although not, while the low-conforming financing do not have the protective assistance necessary for the brand new FHFA, it housing drama was brought about, to some extent, of the a rise in predatory non-conforming funds. In advance of provided one mortgage choice, feedback your financial situation meticulously and make certain you might confidently pay-off everything borrow.

Brand of antique mortgage loans

- Conforming financing. Conforming loans are provided so you can borrowers just who meet up with the conditions set because of the Federal national mortgage association and you can Freddie Mac computer, such as for instance at least credit rating out-of 620 and you may good DTI proportion out-of 43% or quicker.

- Jumbo finance. A great jumbo financing is a non-conforming conventional home loan inside an amount greater than the fresh new FHFA credit restriction. Such finance try riskier than many other conventional funds. To help you decrease one chance, they often wanted huge off costs, highest fico scores and lower DTI percentages.

- Portfolio finance. Most lenders bundle conventional mortgages to each other market all of them to possess earnings inside a system labeled as securitization. However, particular lenders love to retain possession of its fund, which can be labeled as collection financing. Because they do not need see rigorous securitization conditions, profile finance are generally offered to borrowers that have down fico scores, large DTI rates much less reputable profits.

- Subprime money. Subprime loans was non-compliant antique funds accessible to a borrower that have down fico scores, typically less than 600. They often features higher interest rates than many other mortgages, since borrowers which have lowest fico scores are at a higher exposure away from default. It is essential to note that a proliferation out-of subprime loans shared into 2008 construction drama.

- Adjustable-rates money. Adjustable-rate mortgages has actually rates of interest that change-over the life span regarding the borrowed funds. These mortgage loans will feature a primary repaired-price months followed by a time period of fluctuating pricing.

Ideas on how to be eligible for a conventional loan

Conforming traditional money fundamentally give you the least expensive rates and you may one particular positive terms and conditions, nevertheless they might not be available to most of the homebuyer. You will be basically only eligible for such mortgages when you yourself have borrowing from the bank scores of 620 or over and an excellent DTI ratio less than 43%. Additionally must arranged bucks to pay for a down payment. Really loan providers favor a downpayment of at least 20% of the house’s price, even though specific conventional lenders will accept down money only 3%, provided your agree to spend personal financial insurance coverage.

- Try to alter your credit ratings by creating punctual money, cutting your debt and you can maintaining a beneficial combination of revolving and you can installment borrowing from the bank profile. Expert fico scores are designed through the years, thus texture and determination are key.

Otherwise meet up with the over criteria, non-compliant conventional money is generally an option, as the they truly are typically accessible to high-risk consumers having all the way down credit ratings. Although not, be told you will more than likely face higher rates of interest and you can charges than just might which have a compliant loan.

With some determination and a lot of dedication, you might put the brand new groundwork in order to be eligible for a conventional financial. Avoid being frightened to buy to find the correct bank and you may a home loan that suits your specific financial predicament.

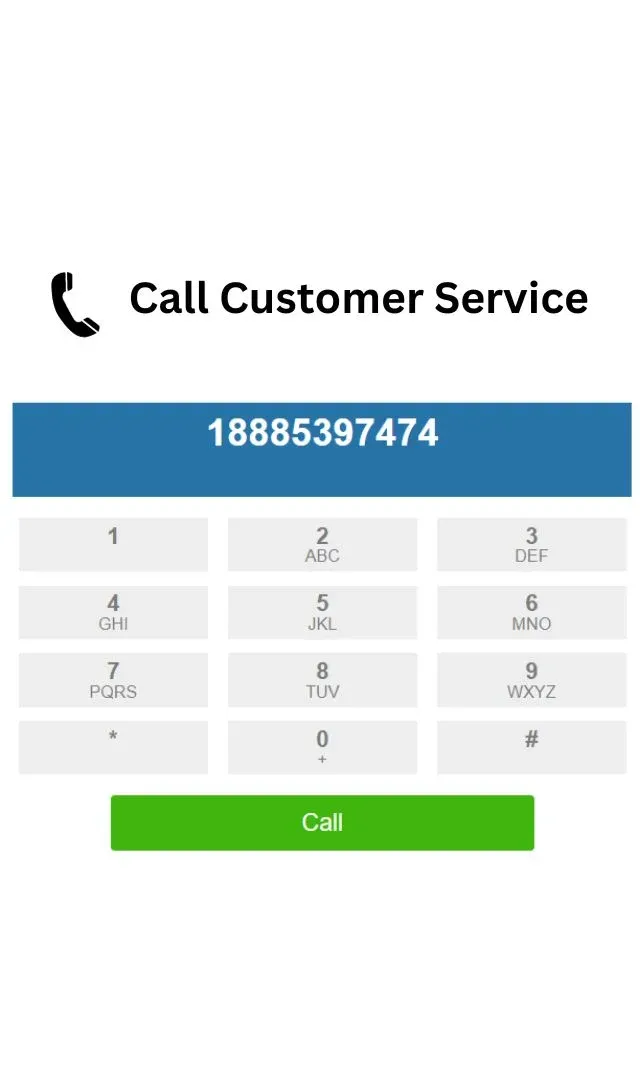

Sign up for a card keeping track of & Identity theft safety product now!

To possess $ 30 days, you could potentially discover what your location is that have accessibility your 3-bureau credit report. Create Equifax Complete TM Premier now!

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!