What is a Cash Flow Statement and How to Prepare it?

Content

First, let’s take a closer look at what cash flow statements do for your business, and why they’re so important. Then, we’ll walk through an example cash flow statement, and show you how to create your own using a template. More accurate data – Expense management solutions don’t always respect the timing difference between expense and payment, which means they don’t always reflect your company’s actual cash position. This strategy can make it difficult to accurately track and report on your company’s true cash position. Payhawk’s integration strategy however, is built in accordance with the accruals principle and respects both dates.

Any company, no matter how big or small, moves on cash, not profits. Learn how thousands of businesses like yours are using Sage solutions to enhance productivity, save time, and drive revenue growth. Sage 300cloud Streamline accounting, inventory, operations and distribution.

Aim of a cash flow statement

Cash flow statements can also give a more accurate look at the company’s available cash. However, some of those expenses may not have actually been paid yet, and some revenue may not have been collected at the time of reporting. Statements of cash flows show the actual accrued and spent cash for the reporting period. After calculating cash flows from operating activities, you need to calculate cash flows from investing activities. This section of the cash flow statement details cash flows related to the buying and selling of long-term assets like property, facilities, and equipment.

This makes it useful for determining the short-term viability of the company, particularly its ability to pay bills. One of the most important features to look for in a potential investment is the company’s ability to produce cash. Just because it reports a profit on the income statement doesn’t mean it is generating sufficient cash. A close examination of the cash flow statement can give investors a better understanding of how the company generates cash and meets its obligations.

What Does a Negative Cash Flow From Financing Mean?

The Structured Query Language comprises several different data types that allow it to store different types of information…

People often mistakenly believe that a cash flow statement will show the profitability of a business or project. Although closely related, cash flow and profitability are different. A cash flow statement lists cash inflows and cash outflows while the income statement lists income and expenses. A cash flow statement shows liquidity while an income statement shows profitability.

How Do You Calculate Cash Flow?

In business strategy, these financial statements can illuminate where a company is overspending and inform changes to the company’s overall approach. Financial analysts will review closely the first section of the cash flow statement, cash flows from operating activities. Part of the review consists of comparing this section’s total to the company’s net income. This is done to see whether the revenues, expenses, and net income reported on the income statement are consistent with the change in the company’s cash balance. We sum up the three sections of the cash flow statement to find the net cash increase or decrease for the given time period.

As an accountant prepares the CFS using the indirect method, they can identify increases and decreases in the balance sheet that are the result of non-cash transactions. The CFS is distinct from the income statement and the balance sheet because it does not include the amount of future incoming and outgoing cash that Cash Flow Statement has been recorded as revenues and expenses. Therefore, cash is not the same as net income, which includes cash sales as well as sales made on credit on the income statements. Cash from financing activities includes the sources of cash from investors and banks, as well as the way cash is paid to shareholders.

Is the Presentation Representative of Actual Cash Inflows and Outflows?

This section may also include dividends paid, although this is sometimes listed under cash from operations. The Governmental Accounting Standards Board began its study of cash flow reporting by evaluating the provisions of FASB 95 within the context of the governmental environment. In 1989, GASB Statement No. 9, Reporting Cash Flows of Proprietary and Nonexpendable Trust Funds and Governmental Entities That Use Proprietary Fund Accounting, was issued. GASB 9 established new guidelines for governments in preparing cash flow statements. A legitimate company has three main activities – operating activities, investing activities and the financing activities. The P&L statement discusses how much the company earned as revenues versus how much the company expanded in terms of expenses.

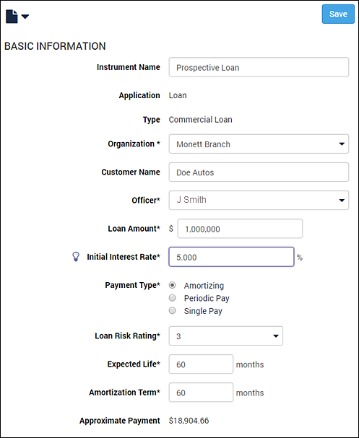

The borrower does not have to put up collateral and the lender relies on credit reputation. Unsecured loans usually carry a higher interest rate than secured loans and may be difficult or impossible to arrange for businesses with a poor credit record. It is assumed that most people are already https://kelleysbookkeeping.com/ familiar with the analysis that usually leads to major capital use decisions in various companies. However, highlighted are some of these points throughout the book, since company backgrounds differ and what is considered «major capital use decisions» varies with the size of businesses.

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!